10 Best Revenue Management Systems Shortlist

Here's my pick of the 10 best software from the 18 tools reviewed.

Stop struggling with manual pricing and outdated tactics. These top-rated Revenue Management Systems leverage data and automation to help you set the perfect price for every product or service, every single time.

Why Trust Our Revenue Management System Reviews?

We’ve been testing and reviewing revenue management systems since 2022. As revenue operation leaders ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different RevOps use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our revenue management system review methodology.

| Tools | Price | |

|---|---|---|

| QuickBooks Online | From $15/user/month | Website |

| Chargebee | From $249/month | Website |

| Maxio | Starts at $599/month | Website |

| Zuora | Pricing upon request | Website |

| Revenue Grid | Pricing upon request | Website |

| SubscriptionFlow | No price details | Website |

| Competera | Pricing upon request | Website |

| Subskribe | Pricing upon request | Website |

| Certinia | Pricing upon request | Website |

| Prisync | From $99/month | Website |

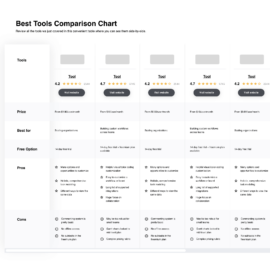

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareHow To Choose Revenue Management Systems

With so many different revenue management systems available, it can be challenging to make decisions on what tool is going to be the best fit for your needs.

As you're shortlisting, trialing, and selecting revenue management systems, consider the following:

- What problem are you trying to solve - Start by identifying the revenue management system feature gap you're trying to fill to clarify the features and functionality the tool needs to provide.

- Who will need to use it - To evaluate cost and requirements, consider who'll be using the software and how many licenses you'll need. You'll need to evaluate if it'll just be the revenue operation leaders or the whole organization that will require access. When that's clear, it's worth considering if you're prioritizing ease of use for all or speed for your revenue management system power users.

- What other tools it needs to work with - Clarify what tools you're replacing, what tools are staying, and the tools you'll need to integrate with, such as accounting, CRM, or HR software. You'll need to decide if the tools will need to integrate together or if you can replace multiple tools with one consolidated revenue management system.

- What outcomes are important - Consider the result that the software needs to deliver to be considered a success. Consider what capability you want to gain or what you want to improve, and how you will be measuring success. For example, an outcome could be the ability to get greater visibility into performance. You could compare revenue management system features until you’re blue in the face but if you aren’t thinking about the outcomes you want to drive, you could be wasting a lot of valuable time.

- How it would work within your organization - Consider the software selection alongside your workflows and delivery methodology. Evaluate what's working well and the areas that are causing issues that need to be addressed. Remember every business is different — don’t assume that because a tool is popular that it'll work in your organization.

Best Revenue Management System Reviews

Below you can find a full rundown of the revenue management software I evaluated, why I think they’re useful, noteworthy features, pricing, and some pros and cons. You can also see a screenshot of each platform.

QuickBooks Online Advanced is a cloud-based accounting software designed for growing businesses with more complex accounting needs. With its advanced features and functionality, QuickBooks Online Advanced helps businesses streamline their accounting processes and make informed financial decisions.

Why I picked Quickbook Online Advanced: I chose QuickBooks Online Advanced for its robust accounting features and advanced reporting capabilities —it’s a great revenue management tool for finance teams. What’s more, its cloud-based design means that data can be accessed from anywhere, which is especially important for businesses with remote teams or multiple locations. Additionally, its affordability and ease of use make it an ideal solution for small to medium-sized businesses looking to improve their accounting processes.

Quickbook Online Advanced Standout Features and Integrations

Features include advanced reporting, custom user permissions, batch invoicing, and automated workflows. It also includes time-saving features like bank reconciliation and cash flow management, as well as integrations with popular business software such as Shopify, PayPal, and Square.

Integrations include Shopify, PayPal, Square, G Suite, TSheets, HubSpot, Bill.com, and more.

Pros and cons

Pros:

- Automated workflows

- Affordable pricing

- Robust accounting and reporting features

Cons:

- Limited customization

- Customer support isn’t outstanding

Chargebee is a cloud-based software designed to help businesses manage and automate their subscription-based billing processes. With its advanced billing capabilities and customizable subscription management tools, Chargebee makes it easy for businesses to scale and optimize their subscription-based revenue streams.

Why I picked Chargebee: I chose Chargebee for its advanced subscription billing features and customizable subscription management tools. Its integrations with popular payment gateways and business software make it easy to implement and manage, even for businesses with limited technical expertise. Additionally, its flexible pricing model means that businesses only pay for the features they need, making it an affordable solution for businesses of all sizes.

Chargebee Standout Features and Integrations

Features include recurring billing, automated dunning, customer self-service, and revenue analytics. It also includes integrations with popular payment gateways such as Stripe, Braintree, and PayPal, as well as integrations with popular business software such as Salesforce, HubSpot, and Zapier.

Integrations include Stripe, Braintree, PayPal, Salesforce, HubSpot, and Zapier, among others.

Pros and cons

Pros:

- Pay-as-you-go pricing available

- Loads of integrations

- Comprehensive subscription management

Cons:

- Limited customization

- Lack of customer support

Maxio is a comprehensive financial operations tool that caters to multiple departments (sales, marketing, finance, etc.) as well as different types of businesses (product-led SaaS and sales-led teams).

Why I picked Maxio: The tool boasts a fairly comprehensive offering, but it’s the subscription billing features that really stood out to me. One of the best ways to increase revenue streams is to customize and increase billing options. To that end, Revenue Grid offers loads of out-of-the-box configurations and lets you add additional offerings like usage-led pricing to capture additional revenue.

Maxio Standout Features and Integrations

Features: Billing customization isn’t the only feature SaaS companies will love. There is a dunning system to reduce involuntary churn, chargeback automation, some pretty detailed reporting functionality, and automated revenue recognition.

Integrations are numerous. There is an integration for almost every major business app, including HubSpot, Google apps, Mailchimp, Keap, Slack, Twilio, and Zendesk.

Pros and cons

Pros:

- Great range of integrations

- Features for every department

- Plenty of billing concepts to increase revenue

Cons:

- Implementation can be overwhelming

- Customization is limited

Zuora is a subscription management platform. It’s product offering is aimed at any business model, but it’s a particularly effective solution for SaaS companies looking to grow their subscription-based business through custom pricing offerings.

Why I picked Zuora: Zephyr is Zuora’s subscription experience platform that lets SaaS brands create customized subscription experiences for their clients. If you’ve ever wanted to personalize your customer experience, this is how I recommend you do it. Zephyr lets you create unique messaging for each customer, enrich interactions with first-party data, and, ultimately, extract as much revenue as possible.

Zephyr Standout Features and Integrations

Features include a billing solution to help you monitor and manage subscriptions, a revenue recognition tool, CPQ capabilities, and the ability to add multiple different revenue streams to your product. I love that it is a no-code solution, which means it’s easy for anyone on your team to build and manage subscription workflows.

Integrations: There aren't any first-party integrations with the platform. But Zuora provides low-code SDKs and APIs that let developers integrate your own applications into the platform.

Pros and cons

Pros:

- Easy implementation

- Easy to use

- Customized subscription workflow

Cons:

- Limited reporting functionality

- Limited integrations

Revenue Grid is a revenue intelligence solution that increases pipeline visibility and helps your reps complete deals and optimize revenue. Your finance team may not find much use for the platform, but it could be a bit of a game changer if you use sales reps to close enterprise accounts.

Why I picked Revenue Grid: There aren’t many revenue management systems aimed squarely at sales reps, but this is one of the most comprehensive solutions that is. It provides reps with a range of features to help them sell, but the platform’s AI-powered Signals is the one I think is the most powerful. It provides guided selling suggestions (like when to send a follow-up email) that eliminate guesswork and help your team drive through more deals.

Revenue Grid Standout Features and Integrations

Features include automatic activity capturing through Salesforce, performance and revenue reports, pipeline visibility, and sales forecasting.

Integrations are available for a range of sales tools. This includes Salesforce, Oracle, SAP, Zoom, Outlook, and Dropbox.

Pros and cons

Pros:

- Automatic activity recording

- AI sales recommendations

- Native Salesforce integration

Cons:

- Some integrations get disconnected

- Sync errors can occur

SubscriptionFlow is a subscription management platform that uses AI to automate and optimize most parts of the subscription billing process. What that means is that you can automate subscription cycles, take the best actions to limit churn, and generate real-time insights

Why I picked SubscriptionFlow: The software is a pretty robust all rounder for managing SaaS subscriptions, but it has a standout freemium and trial feature. It offers a lot more flexibility when it comes to creating trials compared to other systems, and automates a lot of the process. Subscribers can extend their trial with a single click, for instance, and they get automated reminders to upgrade. The software also lets you track trial usage and use that data to incentivize upgrades.

SubscriptionFlow Standout Features and Integrations

Features: In addition to it’s freemium and trial offerings, SubscriptionFlow handles recurring billing, lets you offer metered billing, automatically retries failed payments, and has some pretty in-depth reporting and analytics tools.

Integrations are plentiful. SubscriptionFlow integrates with platforms like WordPress, Shopify, and Webflow, as well as all major accounting systems, CRMs like Salesforce and HubSpot, and marketing platforms like Mailchimp.

Pros and cons

Pros:

- Awesome support

- All-in-one subscription billing solution

- Clear user interface

Cons:

- More documentation would be useful

- No sandbox area for testing

Competera is a cloud-based revenue management system that provides a range of pricing tools to help SaaS and ecommerce brands maximize their revenue and stay ahead of competitors. It’s not an all-in-one solution like some other options on this list, but it excels at the couple of things it does.

Why I picked Comptera: To put it simply, this is the software to use if you want to optimize your product pricing. The tool uses a huge number of data points (things like competitive data, seasonality, the weather, inventory levels, shopping history, elasticity, you get the picture) to create an optimal pricing structure. If that weren’t enough, it even lets you change how prices are calculated to achieve goals like getting rid of stock or recovering previously lost margins.

Comptera Standout Features and Integrations

Features: Comptera’s main feature is its pricing platform that I’ve described above. But it also offers competitive data analysis that lets you compare your pricing to your competitors, and pricing automation, which automatically suggests prices for products.

Integrations: Competera integrates with a variety of other software solutions, including ERP, CRM, and ecommerce platforms. Some of its integrations include SAP, Magento, Salesforce, and Oracle.

Pros and cons

Pros:

- User-friendly interface

- Machine learning algorithms

- Customizable pricing strategies

Cons:

- One-dimensional solution

- Lack of customer support

Subskribe is a quote-to-revenue platform for SaaS businesses. It’s an all-in-one solution for SaaS sales and revenue teams, letting them create custom quotes, go live with custom billing, and then recognize revenue.

Why I picked Subskribe: It’s a great tool for enterprise sales teams looking to go from quote to billing as quickly as possible. The tool’s CPQ feature is particularly powerful. Reps can create complex, multi-year quotes that improve conversion rates, automate their approval workflows, and sync everything with Salesforce and HubSpot.

Subskribe Standout Features and Integrations

Features also include a subscription billing management tool. It automatically reconciles payments and recognizes revenue. Multiple billing methods are available and you can even use reseller functionality to grow revenue further. I especially appreciated the automated tax calculations to make sure you remain compliant.

Integrations are available for Salesforce, Avalara, and DocuSign.

Pros and cons

Pros:

- Salesforce integration

- Subscription management

- Loads of features for sales teams

Cons:

- Lack of guided selling

- Lack of integrations

Certinia is a cloud-based enterprise resource planning (ERP) solution designed to help businesses of all sizes manage their financial and operational processes. It’s a comprehensive offering. Its suite of applications includes accounting, supply chain management, human resources, project management, and more. But it’s forecasting where the platform really stands out.

Why I picked Certinia: Tracking and forecasting revenue is an essential task for SaaS revenue management. Certinia offers a dedicated solution that integrates your CRM, accounting and revenue recognition operations in one place. You can see recognized and deferred revenue at a glance in the tool’s dashboard, and you can even forecast revenue from individual products as well as revenue.

Certinia Standout Features and Integrations

Features: The platform consolidates data from multiple sources to automate several accounting processes, including revenue recognition. And the detailed audit trail really stood out as a great addition. You can also use the platform to manage subscription billing operations, and it supports a range of specialized and hybrid business models.

Integrations are available for a range of business applications, including Salesforce, Avalara, ADP, Jira, DocuSign, and Xactly. There is also API functionality to create your own.

Pros and cons

Pros:

- Native Salesforce integration

- Highly customizable

- Detailed forecasting capabilities

Cons:

- Steep learning curve

- Can be expensive

Prisync is competitor price tracking software designed to help ecommerce businesses monitor and optimize their pricing strategy. It provides real-time pricing data for a host of competitors, allowing you to adjust your prices to remain competitive.

Why I picked Prisync: When a quick Google search helps consumers find the best price for a particular product, having the upper hand over your competitors can make all the difference for an ecommerce store. And with Prisync you don’t have to trawl through your competitors’ sites one by one. Instead, all pricing and stock availability is collated in a single dashboard.

Prisync Standout Features and Integrations

Features include real-time data on competitor pricing, including product descriptions, images, and stock availability. It also includes a range of customization options, allowing businesses to set their own pricing rules and strategies. There’s some reasonably detailed analytics and insights functionality, too.

Integrations: Prisync integrates with a wide range of ecommerce platforms, including Shopify, Magento, WooCommerce, as well as dozens of other business apps. That includes ecommerce-focused solutions like Shipbob, Recart, and Octane AI.

Pros and cons

Pros:

- User-friendly interface

- Easy-to-use dashboard

- Huge range of competitor info

Cons:

- Initial setup can be time-consuming

- Can be expensive for large stores

Other Revenue Management Software

Related Revenue Management System Reviews

If you still haven't found what you're looking for here, check out these tools closely related to revenue management systems that we've tested and evaluated.

- CRM Software

- Sales Software

- Lead Management Software

- Business Intelligence Software

- Contract Management Software

- CPQ Software

Selection Criteria For Revenue Management Systems

Selecting the right revenue management system (RMS) is pivotal for businesses looking to optimize their revenue operations and address specific financial challenges. Through my firsthand experience and comprehensive research into these tools, I've developed a set of criteria designed to evaluate RMS solutions based on their functionality, usability, and ability to meet common industry use cases.

An effective RMS should offer a blend of predictive analytics, pricing optimization, and reporting capabilities, among other features, to support strategic decision-making and revenue growth.

Core Revenue Management System Functionality: - 25% of total weighting score

To be considered for inclusion on my list of the best revenue management systems, the solution had to support the ability to fulfill common use cases:

- Accurate demand forecasting and analysis

- Dynamic and strategic pricing optimization

- Comprehensive revenue opportunity identification

- Effective inventory and channel management

- Detailed performance analytics and reporting

Additional Standout Features: - 25% of total weighting score

Beyond basic functionalities, top-tier RMS solutions distinguish themselves with:

- AI and machine learning for advanced predictive analytics

- Real-time market data integration for competitive pricing

- Customizable dashboards for at-a-glance performance insights

- Automated recommendations for revenue maximization strategies

- Advanced segmentation tools for targeted pricing strategies

Exploring and testing these features helps identify RMS solutions that not only meet but exceed standard expectations, providing businesses with a competitive edge in revenue management.

Usability: - 10% of total weighting score

Ease of use is crucial for ensuring widespread adoption:

- User-friendly interface with intuitive navigation

- Customizable views and easy access to key data

- Quick setup and minimal training required

- Mobile access for on-the-go management

Onboarding: - 10% of total weighting score

A smooth onboarding process is essential for quick implementation:

- Comprehensive training resources and materials

- Dedicated support for setup and integration

- Online tutorials and webinars for user education

- Active user communities for peer support

Customer Support: - 10% of total weighting score

Reliable customer support enhances the user experience:

- Multiple support channels (phone, email, chat)

- Prompt and knowledgeable assistance

- Proactive system updates and maintenance alerts

- User feedback loops for continuous improvement

Value For Money: - 10% of total weighting score

Evaluating cost versus benefits is key:

- Transparent pricing models with clear ROI

- Scalable plans that grow with your business

- Free trials or demos to evaluate system functionality

- Cost-effective solutions without compromising on quality

Customer Reviews: - 10% of total weighting score

Genuine user feedback provides valuable insights:

- Positive experiences with system functionality and support

- Success stories of revenue growth and optimization

- Constructive feedback leading to product enhancements

- High overall satisfaction rates among users

By applying these criteria, I guide software buyers toward RMS solutions that not only streamline and enhance revenue operations but also align with strategic goals for growth and efficiency. The ideal revenue management system offers advanced analytical capabilities, user-friendly interfaces, and customizable features that adapt to specific business needs, driving informed decision-making and maximizing revenue potential.

Trends In Revenue Management Systems For 2024

Revenue management systems (RMS) have seen considerable innovation, reflecting the growing complexity of managing revenue operations across industries. As businesses strive for greater efficiency, accuracy, and strategic insight into their revenue management practices, the latest trends in RMS technology highlight a shift towards more advanced, integrated, and user-centric solutions.

These trends are driven by the need to address specific challenges in revenue operations, such as optimizing pricing strategies, forecasting demand with greater precision, and leveraging data for informed decision-making. Below, we explore the key trends shaping the future of revenue management systems, each responding to distinct needs within the revenue operations domain.

Advanced Analytics and AI

- AI-Driven Forecasting and Pricing: Incorporation of artificial intelligence for dynamic pricing and accurate demand forecasting has become more sophisticated, offering businesses the ability to adapt pricing strategies in real-time based on market conditions.

- Evidence: RMS now feature AI algorithms that analyze historical data and current market trends to predict future demand patterns, enabling more precise pricing adjustments.

- Predictive Analytics for Revenue Optimization: The use of predictive analytics to identify revenue opportunities and optimize pricing strategies is rapidly evolving, providing deeper insights into potential revenue growth areas.

- Evidence: Enhanced analytical models that not only forecast demand but also recommend specific actions to maximize revenue potential across different customer segments and channels.

Integration and Automation

- Seamless Integration with Other Business Systems: The trend towards tighter integration with CRM, ERP, and other operational systems ensures that revenue management decisions are informed by comprehensive, real-time data from across the business.

- Evidence: RMS solutions now offer advanced API integrations, facilitating seamless data exchange and holistic views of business operations for more integrated revenue management.

- Automated Revenue Management Processes: Automation of key revenue management tasks, from data collection to pricing adjustments, is becoming more prevalent, reducing manual effort and increasing operational efficiency.

- Evidence: Deployment of automated workflows for routine revenue management activities, enabling teams to focus on strategy and decision-making.

User Experience and Accessibility

- Enhanced User Interfaces and Dashboards: Improvements in the user experience, with more intuitive interfaces and customizable dashboards, make complex data analysis more accessible to users at all levels of the organization.

- Evidence: Introduction of user-friendly design elements and customizable dashboard configurations that simplify the interpretation of complex data sets for strategic planning.

- Mobile Accessibility and Cloud-Based Solutions: As remote work and on-the-go access become standard, RMS providers are focusing on mobile-friendly solutions and cloud-based platforms for greater accessibility and flexibility.

- Evidence: Development of mobile apps and cloud platforms that provide users with access to critical revenue management tools and data from anywhere, at any time.

These trends underscore a shift towards making revenue management systems more intelligent, integrated, and user-friendly. For revenue operation leaders, leveraging these advancements means not only enhancing operational efficiency but also gaining strategic insights that drive revenue growth. As the field of revenue management continues to evolve, selecting an RMS that aligns with these trends will be crucial for businesses aiming to stay competitive and maximize their revenue potential.

What Are Revenue Management Systems?

A revenue management system (RMS) is a software solution used by businesses to optimize pricing, inventory, and revenue strategies. It utilizes data analytics and predictive modeling to understand and forecast market demand, adjust pricing in real-time, and manage inventory efficiently. This system is particularly prevalent in industries like hospitality, airlines, and retail, where dynamic pricing and inventory management are crucial.

The benefits of a revenue management system include maximizing revenue through strategic pricing and inventory control. It enables businesses to make data-driven decisions, accurately predicting market demand and responding to market fluctuations effectively. By implementing dynamic pricing, businesses can optimize sales and revenue yield. The system also provides insights into customer behavior and market trends, aiding in developing tailored business strategies and gaining a competitive edge in the marketplace.

Features Of Revenue Management Systems

Selecting a robust RMS is crucial for organizations aiming to maximize their revenue potential and streamline operations. The right RMS can transform data into actionable insights, optimize pricing strategies, and ensure that revenue opportunities are not only identified but fully leveraged. Here are the most important features to look for in a revenue management system to effectively manage revenue operations:

- Dynamic Pricing Capabilities: Allows for real-time pricing adjustments based on market demand. This feature is critical for responding to market fluctuations promptly, ensuring pricing strategies always align with current conditions.

- Demand Forecasting: Utilizes historical data and analytics to predict future demand. Accurate forecasting is essential for making informed decisions about pricing, promotions, and inventory management, directly impacting revenue optimization.

- Competitive Analysis Tools: Offers insights into competitors’ pricing and market position. Understanding the competitive landscape helps in strategizing pricing and marketing efforts more effectively to gain a competitive edge.

- Channel Management: Manages different sales channels efficiently. Effective channel management ensures that all platforms are optimized for sales, contributing to a comprehensive revenue strategy.

- Customer Segmentation: Categorizes customers into different segments based on behavior and preferences. Segmentation allows for targeted marketing and pricing strategies, increasing conversion rates and customer satisfaction.

- Revenue Optimization Algorithms: Applies algorithms to identify revenue-maximizing opportunities. Leveraging advanced algorithms helps in uncovering hidden revenue potentials within operations, enhancing overall profitability.

- Integration with Business Systems: Seamlessly connects with CRM, ERP, and other operational tools. Integration ensures data consistency across systems, providing a holistic view of the business for better decision-making.

- Reporting and Analytics: Delivers comprehensive reports and dashboards. Access to detailed analytics and custom reports is indispensable for tracking performance and making data-driven adjustments to revenue strategies.

- User-Friendly Interface: Features an intuitive design and navigation. A user-friendly RMS encourages adoption across the organization, making critical data and tools accessible to all relevant stakeholders.

- Cloud-Based Platform: Offers flexibility and accessibility through cloud technology. Cloud-based solutions provide the scalability and accessibility needed for businesses to manage revenue operations effectively, regardless of location.

Selecting a revenue management system with these features equips businesses with the tools necessary to navigate the complexities of modern revenue operations. By enabling dynamic pricing, detailed analytics, and effective channel management, among others, an RMS becomes an invaluable asset in strategizing for revenue growth and operational efficiency.

Benefits Of Revenue Management Systems

Revenue management systems have emerged as indispensable tools. By leveraging advanced analytics, dynamic pricing, and demand forecasting, RMS enable organizations to make informed decisions that significantly impact their bottom line. For potential buyers exploring revenue operations management software, understanding the key benefits of these systems can illuminate how they transform strategic planning and execution. Here are five primary benefits:

- Optimized Pricing Strategies: Enables dynamic pricing adjustments based on real-time market data. Utilizing an RMS allows businesses to set prices that reflect current market demand, enhancing competitiveness and maximizing revenue.

- Enhanced Decision Making: Provides actionable insights through advanced analytics. The depth of analysis offered by RMS supports strategic decisions, helping businesses identify opportunities for growth and areas for improvement.

- Increased Efficiency: Automates complex revenue management tasks. By reducing manual effort in data analysis and pricing adjustments, organizations can allocate resources more effectively, focusing on strategy and innovation.

- Improved Financial Performance: Identifies revenue opportunities across channels. RMS give businesses the tools to uncover hidden revenue potential, whether through better inventory management, channel optimization, or customer segmentation, leading to improved financial outcomes.

- Strategic Revenue Growth: Supports long-term revenue optimization strategies. With the insights and tools provided by an RMS, businesses can develop and implement strategies that drive sustainable revenue growth, ensuring they remain competitive and responsive to market changes.

Costs & Pricing For Revenue Management Systems

Navigating the diverse landscape of revenue management systems can be a daunting task for software buyers, especially those new to the technology. Revenue management systems are designed to optimize pricing, inventory, and overall revenue strategies through data analysis and forecasting. These systems vary widely in features, scalability, and pricing, catering to the needs of different industries and business sizes.

Understanding the various plan options and their corresponding features is essential for selecting a system that aligns with your business goals and budget. Below is a simplified overview of typical plan options for RMS and their pricing.

Plan Comparison Table For Revenue Management Systems

| Plan Type | Average Price | Common Features Included | Best For |

|---|---|---|---|

| Basic | $200 - $500 per month | - Basic forecasting and reporting - Manual data input and analysis - Simple inventory management | - Basic forecasting and reporting - Manual data input and analysis - Simple inventory management |

| Professional | $1,000 - $2,500 per month | - Advanced analytics and forecasting - Dynamic pricing tools - Integration with other business systems - Multi-channel management | - Advanced analytics and forecasting - Dynamic pricing tools - Integration with other business systems (PMS, CRM) - Multi-channel management (OTAs, website) |

| Enterprise | $5,000+ per month | - Comprehensive revenue optimization - Customizable dashboards and reports - AI and machine learning capabilities - Dedicated support and consultancy | - Comprehensive revenue optimization - Customizable dashboards and reports - AI and machine learning capabilities - Dedicated support and consultancy |

| Free option | $0 | - Limited forecasting capabilities - Basic reporting tools - Access to community support forums | - Limited forecasting capabilities - Basic reporting tools - Access to community support forums |

When considering which plan to choose, it's important to assess both the current and future needs of your business. Opt for a plan that not only fits your budget but also provides the flexibility to scale as your business grows.

Revenue Management System Frequently Asked Questions

Looking for more information on choosing and using a revenue management system? Here are answers to frequently asked questions that should help.

What are the types of revenue management systems?

How do revenue management systems optimize pricing strategies?

What role do revenue management systems play in risk management?

How do revenue management systems manage and process different revenue streams?

What are the pillars of revenue management?

How do you measure the success of revenue management?

Alternative RevOps Software Reviews

Here are some other revenue operations software categories that you might want to consider.

- Best Sales Software

- Pricing Software

- Data Visualization Software

- Predictive Analytics Software

- Sales Forecasting Software

- Business Intelligence Software

- Sales Reporting Software

- Sales Intelligence Software

- KPI Software

- Sales Tracking Software

Conclusion

Revenue management systems can streamline your accounting operations and help your sales teams to maximize revenue. They certainly remove some of the headaches that SaaS brands have to deal with when it comes to managing billing and recognizing revenue. So I hope my detailed breakdown has helped you find the right system for your team.

For more expert advice regarding revenue management and other similar topics, sign up for our newsletter.