Best Insurance CRM Software Shortlist

Here's my pick of the 10 best software from the 20 tools reviewed.

Our one-on-one guidance will help you find the perfect fit.

Managing client relationships and streamlining operations in the insurance industry can be daunting, especially with the vast amount of data and complex regulatory requirements. However, finding the right software to help you manage these processes can sometimes feel equally as overwhelming.

As a revenue operations manager, I’ve seen firsthand how the best CRM software can transform these challenges into opportunities for growth. That’s why, using my experience in digital software, I tested and reviewed several of the top insurance CRM software solutions on the market.

By leveraging these tools, agencies can optimize their operations, boost productivity, and ultimately increase revenue. Whether you’re looking to upgrade your current system or implement a new one, this guide will help you make an informed decision that aligns with your business goals.

Why Trust Our Software Reviews

We’ve been testing and reviewing CRM software since 2022. As revenue operations experts ourselves, we know how critical and difficult it is to make the right decision when selecting software. We invest in deep research to help our audience make better software purchasing decisions.

We’ve tested more than 2,000 tools for different revenue operations use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our software review methodology.

Best Insurance CRM Software Summary

| Tools | Price | |

|---|---|---|

| CRM Creatio | From $25/user/month | Website |

| Vtiger | From $12/user/month (billed annually) | Website |

| Insightly | From $29/user/month (billed annually) | Website |

| InsureCRM | Pricing upon request | Website |

| Insly | Pricing upon request | Website |

| Vymo | Pricing upon request | Website |

| Applied Epic | Pricing upon request | Website |

| Radius | From $43/month | Website |

| Shape | From $47/user/month (billed annually) | Website |

| Salesforce Financial Services Cloud | From $25/user/month (billed annually) | Website |

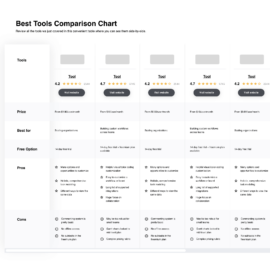

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareHow to Choose Insurance CRM Software

As you work through your unique software selection process, keep the following points in mind:

- Integration Capabilities: Ensure your chosen CRM software can integrate with your existing systems, such as policy management and claims processing software. This is important for maintaining a unified view of customer needs, interactions, and policy details.

- Customization Options: Look for an insurance CRM software that offers customization options that fit your business processes and workflows. Features such as customizable dashboards and reporting tools can help tailor the software to meet these needs, providing more relevant insights and a better user experience.

- Compliance and Security: The insurance industry is heavily regulated. As a result, your CRM software must comply with industry standards and regulations such as GDPR, HIPAA, and others. Additionally, make sure the software has strong security features to protect sensitive customer data.

- Customer Support and Training: Evaluate the customer support and training provided prior to purchasing a software. Ensure that onboarding and ongoing support are essential for maximizing the software's potential.

- Scalability: Choose a CRM solution that can grow with your business. As your customer base expands and your operations become more complex, the software should be able to handle increased data volume and user load, saving time and resources in the long run.

Best Insurance CRM Software Reviews

This section provides an in-depth analysis and overview of each insurance CRM software. Below, I will review the pros and cons, their features, and their best use cases.

Creatio CRM is a no-code, customizable customer relationship management tool. It supports the entire sales cycle, from lead generation to repeat sales, and is bolstered by advanced analytics and marketing automation capabilities.

Why I picked CRM Creatio: The platform supports comprehensive customer relationship management by providing a 360-degree view of client interactions, which is essential for personalized service and effective communication. Its no-code platform also allows insurance companies to customize and automate their workflows without requiring extensive technical expertise. This can include everything from underwriting and claims processing to policy administration and customer service.

Standout features & integrations:

Features include workflow automation, customizable dashboards, real-time analytics, AI-assisted app development, contact and account management, lead and opportunity management, task management, and performance management.

Integrations include Accelo, Act!, ActiveCampaign, Acumatica, Adobe Analytics, Asana, Microsoft Exchange, Excel, Mailchimp, HubSpot Marketing Hub, Google Calendar, and Tableau.

Pros and cons

Pros:

- No-code platform

- Customizable dashboards

- Strong reporting and analytics

Cons:

- Extensive customization can be time-consuming

- Learning curve for new users

Vtiger is a CRM software that offers customizable workflows and a range of features to support sales activities, marketing, and customer service.

Why I picked Vtiger: Vtiger provides tools to create and manage customizable workflows, enabling coordination among various departments. The software’s workflow automation allows users to define custom rules and actions, ensuring tasks like policy renewals, claim follow-ups, and customer notifications are handled efficiently and supports advanced workflow triggers and actions. Additionally, Vtiger offers advanced customization options that allow users to configure fields, modules, and layouts that align with insurance processes and business requirements.

Standout features & integrations:

Features include customizable workflows, sales automation, advanced reporting and analytics, and a low-code platform for creating tailored solutions.

Integrations include Google Workspace, Microsoft Teams, Zoom, Mailchimp, QuickBooks, Xero, Slack, Dropbox, Twilio, and Zapier.

Pros and cons

Pros:

- Pre-built policy management templates

- Dynamic workflows with conditional logic

- Custom insurance module creation

Cons:

- Limited pre-built integrations

- Limited search function

Insightly is a CRM software that streamlines operations and improves insurance agencies' customer relationships. It helps to centralize account management processes, providing a single customer data and interaction platform.

Why I picked Insightly: Insightly excels in centralized account management, a feature beneficial for insurance agencies with large client bases. Its unified database allows for advanced tracking of customer interactions, policy details, and communication history. Insightly also offers project management features, enabling agencies to track policy renewals, claims, and communication. This ultimately improves efficiency and enhances overall customer satisfaction.

Standout features & integrations:

Features include pipeline management, lead tracking tools, centralized account management, built-in email functions, strong data privacy and compliance features, powerful analytics tools, and a user-friendly mobile app.

Integrations include Google Workspace, Microsoft Teams, QuickBooks, Mailchimp, Slack, Dropbox, Xero, Zendesk, Evernote, and Box.

Pros and cons

Pros:

- Custom app and extension development

- Facilitates web-to-lead capture

- Custom relationship linking

Cons:

- Limited objects and field customization

- Limited contact and opportunity management

InsureCRM is an advanced insurance CRM software that helps businesses manage customer relationships and interactions. It automates and streamlines various sales, marketing, and customer service processes, driving more sales.

Why I picked InsureCRM: InsureCRM offers industry-specific functionalities and extensive customization options. It comes with pre-configured and insurance-specific modules that address key areas such as policy lifecycle management, claims tracking, and compliance monitoring. The software also offers powerful automation tools that allow users to automate routine tasks such as policy renewals, premium reminders, and follow-up communications. Lastly, InsureCRM provides deep insights into sales performance, customer behavior, and operational efficiency, allowing insurance brokers and agencies to make informed decisions and optimize their strategies.

Standout features & integrations:

Features include lead management, policy management, customer management, claims management, document management, task management, email integration, reporting and analytics, workflow automation, mobile access, customizable dashboards, and role-based access control.

Integrations include QuickBooks, Microsoft Navision, Sage 300, and Beehive.

Pros and cons

Pros:

- Policy renewal automation

- Comprehensive claims management system

- Pre-configured insurance modules

Cons:

- Steep learning curve for beginners

- Cost-intensive customization

Insly is a low-code insurance software designed to help insurance businesses grow by simplifying and automating their processes. It provides a fully extensible suite of insurance software solutions that can be combined with custom modules to streamline operations.

Why I picked Insly: Insly stands out for its low-code platform, allowing insurance companies to customize and extend the software without technical skills. This empowers users to create custom workflows, automate processes, and easily integrate with other systems. It has a drag-and-drop interface for users to build and modify applications to suit business needs and powerful policy management capabilities, including tools for handling police issuance, renewals, endorsements, and cancellations. Additionally, its advanced claims management system allows users to track and process claims efficiently, ensuring timely settlements.

Standout features & integrations:

Features include a product builder with forms, workflows, a rating engine, a document template editor, and capacity management. Insly also offers product distribution with broker channel support, underwriting, policy administration, premium handling, reporting, and claims management.

Integrations include Google Workspace, Microsoft Teams, Salesforce, HubSpot, Mailchimp, QuickBooks, Xero, Stripe, PayPal, and Zapier.

Pros and cons

Pros:

- Easy quote and proposal generation

- Tools for policy lifecycle management

- Automated claims processing

Cons:

- Limited workflow customization

- Limited reporting flexibility

Vymo is an AI-powered insurance distribution management platform that offers solutions for producer recruitment, accelerated sales growth, AI performance insights, and guided selling.

Why I picked Vymo: Vymo enhances the productivity and effectiveness of insurance agents through intelligent automation and data-driven insights. The platform leverages AI to automate tasks, provide real-time recommendations, and deliver actionable insights to help agents prioritize their efforts and close more deals. It analyzes data to identify patterns and trends and suggest personalized communication strategies based on client behavior.

Standout features & integrations:

Features include modular applications for simplifying recruitment, onboarding, and compliance, as well as AI-enabled performance insights for insurance leadership.

Integrations include Salesforce, Microsoft Dynamics, Oracle, SAP, HubSpot, Zoho CRM, Slack, Google Workspace, Microsoft Office 365, and Mailchimp.

Pros and cons

Pros:

- Dynamic sales routing

- Behavior-based insights for personalized communication

- AI-powered lead prioritization

Cons:

- Heavy battery consumption for mobile app

- Occasional issues with OTP

Applied Epic is an advanced agency management system designed to streamline insurance operations and manage all roles, locations, and lines of business within a single platform.

Why I picked Applied Epic: Applied Epic integrates every aspect of insurance agencies into a single platform. It allows smooth management of policies, clients, claims, and accounting, ensuring synchronized and efficient operations. The software also offers a strong client management system that keeps records of all client interactions, policy details, and claims history. Additionally, Applied Epic’s automated communication features, like email reminders and notifications, help maintain regular and timely contact with clients for stronger relationships and improve retention rates.

Standout features & integrations:

Features include a flexible and open platform that supports acquisitions and integrations, an intuitive user experience, integrated benefits management, process automation, and powerful reporting and data analytics.

Integrations include Vertafore's PL Rating, Docusign, CSR24, ImageRight, RiskMatch, ReferenceConnect, Sircon, BenefitPoint, Sagitta, and WorkSmart.

Pros and cons

Pros:

- Cloud-based for real-time access to data

- Comprehensive document management and marketing automation

- Detailed client management

Cons:

- Resource-intensive and difficult data migration

- Required extensive training

Radius is an agency management system that combines telephony solutions with solid marketing automation tools, allowing agents to manage calls and campaigns from a single platform.

Why I picked Radius: Radius enhances communication and streamlines marketing efforts, making it an ideal choice for insurance agencies looking to improve their outreach and customer engagement strategies. The software integrates VoIP capabilities directly into the CRM platform, allowing agents to make and receive calls, track call histories, record conversations in one platform and centralize all client communications. Radius’ automation tools help with email campaigns, lead nurturing, and follow-up reminders, driving higher engagement and conversion rates.

Standout features & integrations:

Features include sales automation, marketing automation, integrated VoIP, lead distribution, task assignments, and marketing campaigns.

Integrations include Zapier, Mailchimp, Google Calendar, Outlook, Twilio, Docusign, QuickBooks, Slack, HubSpot, and Salesforce.

Pros and cons

Pros:

- Omnichannel integration

- Automated lead scoring

- Integrated VoIP system

Cons:

- Steep learning curve for extensive functions

- Performance issues with high call volumes

Shape is a versatile insurance CRM software for streamlining policy management, enhancing customer relationships, and optimizing sales processes for insurance agencies.

Why I picked Shape: Shape offers full functionality without multiple add-ons or integrations. It’s a holistic solution that includes everything an insurance agency needs to operate smoothly, including management tools, automated marketing campaigns, detailed reporting and analytics, and a solid customer relationship management system. The platform can handle the complexities of insurance operations, from policy management to claims processing, ensuring all aspects of the business are streamlined and optimized.

Standout features & integrations:

Features include a lead engine for converting web traffic, email automation with pre-built templates, an integrated phone system, text messaging capabilities, a customer point of sale portal, lead scoring with ShapeIQ, a mobile app, and Shape AI for leveraging artificial intelligence.

Integrations include Zapier, Mailchimp, Google Calendar, Outlook, QuickBooks, Slack, Twilio, Docusign, Stripe, and Zoom.

Pros and cons

Pros:

- Comprehensive lead management system

- Unified CRM software, marketing, and business platform

- Personalized and targeted marketing campaigns

Cons:

- Learning curve for extensive features

- Limited reporting functionalities

Salesforce is a powerful and highly customizable platform that provides advanced tools for managing policyholder relationships. It has strong analytics and AI-driven insights, enabling insurance agents to optimize sales strategies.

Why I picked Salesforce: Salesforce offers a tools suite for managing policyholder relationships, tracking claims, and automating routine tasks. The platform also supports features like automated policy renewals, premium tracking, and claims management, all in a single interface. Additionally, Salesforce has the Financial Services Cloud that provides a 360-degree view of clients, enabling insurance agents to deliver personalized services and build stronger relationships.

Standout features & integrations:

Features include purpose-built insurance solutions for life and annuity, group benefits, and property and casualty insurance. The Financial Services Cloud also offers digital process innovation across the front, middle, and back offices.

Integrations include Microsoft Outlook, Google Workspace, Slack, Docusign, LinkedIn, QuickBooks, Mailchimp, HubSpot, Zendesk, and Tableau.

Pros and cons

Pros:

- Support for multinational operations

- Customizable dashboards for insurance operations

- AI-driven insights for cross-sell or up-sell opportunities

Cons:

- Potential performance issues if not properly optimized

- Steep learning curve and complex implementation

Other Insurance CRM Software

Below is a list of additional insurance CRM software that I shortlisted. While they didn’t make the top 10, they’re still valuable and worth further research.

- Cloven

For Canadian life insurance agents

- AgencyBloc

For health and life insurance agencies

- FiveCRM

For streamlined data management

- Copper

For G Suite integration

- HubSpot CRM

For marketing integration

- monday.com

For team collaboration

- Zoho CRM

For customizable workflows

- Maximizer

For comprehensive client management

- Odoo

For modular business apps

- Equisoft

For financial planning tools

Related CRM Reviews

If you still haven't found what you're looking for here, check out these tools closely related to all-in-one CRMs that we've tested and evaluated.

- CRM Software

- Sales Software

- Lead Management Software

- Business Intelligence Software

- Contract Management Software

- Revenue Management System

- CPQ Software

Insurance CRM Software Selection Criteria

The criteria for choosing an insurance CRM software should directly address buyer needs and common pain points, ensuring that the software serves its intended purpose effectively. As an expert who has personally tried and researched these tools, here are the requirements I use when evaluating software:

Core Functionality (25% of total score):

- Policy management

- Customer relationship management

- Claims processing

- Analytics and reporting

- Document management

Additional Standout Features (25% of total score):

- Integration with third-party applications

- AI-driven insights and automation

- Customizable dashboards and reports

- Mobile accessibility

- Advanced security features

Usability (10% of total score):

- Intuitive user interface

- Drag-and-drop functionality

- Customizable workflows

- Easy navigation

- Minimal learning curve

Onboarding (10% of total score):

- Availability of training videos

- Interactive product tours

- Chatbots for instant support

- Webinars and live training sessions

- Pre-built templates for quick setup

Customer Support (10% of total score):

- 24/7 customer support availability

- Multiple support channels (phone, email, chat)

- Dedicated account managers

- Comprehensive knowledge base

- Fast response times

Value for Price (10% of total score):

- Competitive pricing

- Flexible subscription plans

- Transparent pricing structure

- Free trial or demo availability

- Cost-benefit analysis

Customer Reviews (10% of total score):

- Overall satisfaction ratings

- Feedback on ease of use

- Comments on customer support quality

- Reviews on feature effectiveness

- Testimonials on ROI and business impact

Trends for Insurance CRM Software

Here are some trends I’ve noticed for insurance CRM software, plus what they might mean for the future. I sourced countless product updates, press releases, and release logs to tease out the most important insights.

- AI-Powered Customer Insights: AI is being used to analyze customer data for deeper insights. This helps insurers personalize their services and improve customer satisfaction and retention.

- Integration with IoT Devices: CRM systems now integrate with IoT devices, allowing for real-time data collection. It enhances risk assessment and policy customization.

- Blockchain for Data Security: Blockchain technology is being adopted for secure data transactions. This ensures data integrity and transparency, which is vital for building customer trust.

- Advanced Analytics for Predictive Modeling: Advanced analytics are being used for predictive modeling, helping forecast customer behavior. It aids in better decision-making and risk management.

- Mobile-First CRM Solutions: Mobile-first CRM solutions are gaining traction. They offer flexibility and accessibility for agents on the go and improve efficiency and customer interaction.

These trends are not only enhancing customer experience but also improving operational efficiency and data-driven decision-making. Staying informed about these innovations will help insurance companies select CRM solutions that align with their strategic goals and customer service objectives.

What is Insurance CRM Software?

Insurance CRM software is designed to help insurance companies manage their customer relationships, sales processes, and policy administration. It’s often used to track client interactions, manage leads, and streamline policy management.

Components of insurance CRM software include contact management, lead tracking, policy management, and reporting tools. These features allow users to maintain detailed records of client interactions, monitor sales pipelines, manage policy renewals, and generate compliance reports.

Features of Insurance CRM Software

When choosing insurance CRM software, it's important to understand the key features that can help manage client relationships and streamline operations. Here are the most important features to look for.

- Contact Management: This feature organizes and stores client information for easy access and updates the client details.

- Policy Tracking: It allows you to monitor the status of insurance policies, ensuring that renewals and claims are managed efficiently.

- Lead Management: This feature helps track potential clients and manage the sales pipeline, improving the chances of converting leads into customers.

- Document Management: It provides a centralized location for storing and retrieving important documents, reducing the risk of losing important information.

- Task Automation: Automating routine tasks saves time and reduces the likelihood of human error, allowing you to focus on more strategic activities.

- Reporting and Analytics: This feature offers insights into sales performance and client behavior, helping you make informed business decisions.

- Integration Capabilities: The ability to integrate with other software systems ensures that data flows smoothly across different platforms, enhancing overall efficiency.

- Customer Support: Solid customer support features help address client issues promptly, improving customer satisfaction and retention.

- Mobile Access: Mobile access allows you to manage client relationships and access important information on the go, increasing flexibility and responsiveness.

- Compliance Management: This feature ensures that your operations adhere to industry regulations, reducing the risk of legal issues.

Choosing the right insurance CRM software with these features can significantly improve your ability to manage client relationships and streamline operations. By leveraging these capabilities, agencies can better manage client data, track interactions, and ultimately deliver more personalized and effective service.

Benefits of Insurance CRM Software

By leveraging CRM software, insurance agencies can streamline operations, improve customer satisfaction, and drive business growth. Below are some of the primary benefits you may experience while using an insurance CRM software.

- Enhanced Customer Service: Each CRM software provides a 360-degree view of the customer, allowing insurance agents to offer personalized service and anticipate client needs. This leads to greater customer satisfaction and retention.

- Increased Productivity: By automating repetitive tasks such as lead management, policy renewals, and claims processing, CRM software frees up time for insurance agents to focus on building relationships with clients and handling complex claims.

- Better Data Management: CRM systems centralize important client information, policy details, and claim history, making it easy for agents to access the data they need to assist their clients efficiently.

- Improved Communication: With a good insurance CRM, teams can facilitate communication with clients through various channels, such as email, text, or phone, ensuring that clients receive personalized messages tailored to their needs, such as renewal reminders or claims updates.

- Powerful Analytics: The right insurance CRM software will provide valuable insights into sales trends, customer behavior, and agent performance, helping insurance companies make data-driven decisions to optimize their operations and improve customer satisfaction.

Insurance CRM software offers numerous advantages that can significantly enhance the efficiency and effectiveness of insurance agencies. By adopting a CRM system, insurance companies can better manage customer relationships, streamline processes, and achieve greater business success.

Costs & Pricing of Insurance CRM Software

This section provides an estimate of average insurance CRM software plans and costs. The pricing varies based on the plan type and the features offered.

Plan Comparison Table for Insurance CRM Software

| Plan Type | Average Price | Common Features |

| Free Plan | $0 | Basic contact management, limited users, basic reporting, and email support |

| Personal Plan | $10 - $20 per user/month | Contact management, email integration, basic automation, and mobile access |

| Business Plan | $30 - $60 per user/month | Advanced automation, sales pipeline management, custom dashboards, and analytics |

| Enterprise Plan | $100 - $300 per user/month | AI-powered insights, advanced customization, multi-channel support, and compliance management |

Insurance CRM Software FAQs

Here are the answers to some frequently asked questions I’ve received about insurance CRM software.

How can I ensure data security and compliance with insurance CRM software?

Ensuring data security and compliance with insurance CRM software involves several key steps. Choose a CRM offering powerful security features such as encryption, secure access controls, and regular security audits. Many CRM systems are designed with compliance in mind, adhering to industry standards and regulations such as GDPR and HIPAA.

Additionally, it is crucial to regularly update the software to protect against vulnerabilities and to train staff on best practices for data security. Implementing multi-factor authentication and maintaining an audit trail of all data access and changes can enhance security and compliance.

What are the integration capabilities of insurance CRM software with other tools?

Insurance CRM software often has extensive integration capabilities to streamline operations and enhance functionality. These integrations allow for seamless data flow between different systems, reducing manual data entry and improving efficiency.

Additionally, many CRMs support API integrations, enabling custom connections with proprietary systems or other third-party tools essential for insurance operations.

How can CRM software improve the efficiency of insurance agents?

CRM software improves the efficiency of insurance agents by automating routine tasks, providing a centralized database for customer information, and facilitating better communication. Features like automated lead assignment, policy management, and follow-up reminders ensure that agents can focus on high-value activities rather than administrative tasks.

How does CRM software help in improving customer retention for insurance companies?

CRM software helps improve customer retention by providing tools to enhance customer service and engagement. Features like automated follow-ups, personalized communication, and comprehensive customer profiles enable agents to maintain regular contact with clients and address their needs promptly.

CRM systems can identify cross-selling and upselling opportunities, helping agents offer relevant products to existing customers, and increasing customer satisfaction and loyalty.

What are the challenges of implementing CRM systems in the insurance sector?

Implementing CRM systems in the insurance sector can present several challenges, including:

- Data Integration: Integrating the CRM with legacy systems can be complex and time-consuming.

- Customization Needs: Insurance companies often require custom features to meet their specific needs, which can increase implementation time and costs.

- Compliance and Security: Ensuring the CRM complies with industry regulations and secures sensitive customer data is critical.

- User Adoption: Training staff to use the new system and ensuring they adopt it can be challenging.

- Cost: The initial investment in CRM software, including licensing, customization, and training, can be significant.

How can CRM software assist in sales forecasting for insurance companies?

CRM software assists sales forecasting by providing detailed analytics and reporting tools that track sales performance and market trends. These insights help set realistic sales targets, allocate resources effectively, and develop strategic marketing campaigns. Additionally, CRM systems can track the progress of leads through the sales pipeline, providing real-time updates on potential sales opportunities.

What’s Next?

Want to take your RevOps game to the next level? Subscribe to The RevOps Team newsletter.