10 Best Financial Services CRM Software Shortlist

Here's my pick of the 10 best software from the 24 tools reviewed.

With so many different financial services CRM software available, figuring out which is right for you is tough. You know you want to manage customer relationships, track offered financial products and services, and comply with regulatory requirements but need to figure out which tool is best. I've got you! In this post I'll help make your choice easy, sharing my personal experiences using dozens of different financial services CRM tools with various teams and clients, with my picks of the best financial services CRM software.

Why Trust Our Financial Services CRM Software Reviews?

We’ve been testing and reviewing financial services CRM software since 2022. As revenue operation leaders ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different RevOps use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our financial services CRM software review methodology.

| Tools | Price | |

|---|---|---|

| Capsule | From $18/user/month (billed annually) | Website |

| CRM Creatio | From $25/user/month | Website |

| HubSpot CRM | From $20/month | Website |

| Zoho CRM | From $15/user/month | Website |

| Practifi | From $120/user/month | Website |

| Act! | From $30/user/month (billed annually) | Website |

| Salesforce Marketing Cloud | Pricing upon request | Website |

| Irwin | Pricing upon request | Website |

| Centrex Software | Pricing upon request | Website |

| Wealthbox CRM | From $49/user/month | Website |

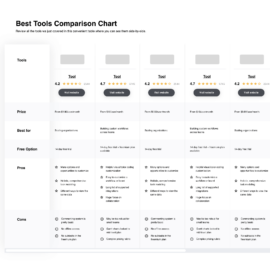

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareHow To Choose Financial Services CRM Software

With so many different financial services CRM software solutions available, it can be challenging to make decisions on what tool is going to be the best fit for your needs.

As you're shortlisting, trialing, and selecting financial services CRM software, consider the following:

- What problem are you trying to solve - Start by identifying the financial services CRM software feature gap you're trying to fill to clarify the features and functionality the tool needs to provide.

- Who will need to use it - To evaluate cost and requirements, consider who'll be using the software and how many licenses you'll need. You'll need to evaluate if it'll just be the revenue operation leaders or the whole organization that will require access. When that's clear, it's worth considering if you're prioritizing ease of use for all or speed for your financial services CRM software power users.

- What other tools it needs to work with - Clarify what tools you're replacing, what tools are staying, and the tools you'll need to integrate with, such as accounting, CRM, or HR software. You'll need to decide if the tools will need to integrate together or if you can replace multiple tools with one consolidated financial services CRM software.

- What outcomes are important - Consider the result that the software needs to deliver to be considered a success. Consider what capability you want to gain or what you want to improve, and how you will be measuring success. For example, an outcome could be the ability to get greater visibility into performance. You could compare financial services CRM software features until you’re blue in the face but if you aren’t thinking about the outcomes you want to drive, you could be wasting a lot of valuable time.

- How it would work within your organization - Consider the software selection alongside your workflows and delivery methodology. Evaluate what's working well and the areas that are causing issues that need to be addressed. Remember every business is different — don’t assume that because a tool is popular that it'll work in your organization.

Best Financial Services CRM Software Reviews

You can use the simple overviews of each tool below to understand how each tool stands out from other financial services CRM software.

Capsule CRM provides a user-friendly platform tailored for small to mid-sized businesses, offering features that help manage customer relationships, sales pipelines, and organizational tasks efficiently. Its simplicity and focus on essential functionalities make it an attractive option for companies looking to implement a CRM without the complexity often associated with larger systems.

Why I Picked Capsule CRM: Capsule CRM stands out as a stellar financial services CRM software due to its intuitive design and powerful features tailored to meet the complex needs of the financial sector. One of the key attributes that makes Capsule exceptional is its ability to streamline client management and sales processes, enabling financial advisors, banking professionals, and insurance agents to efficiently track client interactions, manage leads, and nurture client relationships.

Capsule CRM excels in providing actionable insights through its advanced reporting and analytics tools, which are indispensable for financial services firms aiming to make data-driven decisions. These features offer a clear overview of sales performance, client engagement, and team productivity, enabling businesses to identify trends, measure the effectiveness of their strategies, and adjust their approach accordingly.

Capsule CRM also places a strong emphasis on security and compliance, critical considerations in the financial services industry, by implementing robust data protection measures and ensuring that sensitive client information is handled with the utmost care. Together, these aspects contribute to Capsule CRM's reputation as a reliable and efficient solution that empowers financial services professionals to deliver exceptional client service and achieve their business objectives.

Capsule CRM Standout Features and Integrations

Features include contact management, sales pipeline, task and project management, customization options, integration capabilities, user-friendly interface, mobile access, reporting tools, team collaboration features, security and privacy controls.

Integrations include Google Workspace (Gmail, Docs, Calendar), Microsoft Office 365, Mailchimp, Xero, QuickBooks, Slack, FreshBooks, and more using Zapier.

Pros and cons

Pros:

- More digital marketing integration welcomed

- Can't drag-and-drop data tags or fields

- Send and receive emails right in Capsule CRM

- Integrated calendar tasks management

- Intuitive and easy to use

Creatio is a platform that provides a no-code solution for automating workflows and building applications, as well as offering tools for customer relationship management (CRM), marketing automation, and sales management. It's designed to provide users with a high degree of customization and flexibility. As a financial services CRM, Creatio provides tools for managing the complete customer journey in retail and corporate banking.

Why I Picked CRM Creatio: Creatio has deep customization capabilities and industry-specific solutions that address the unique challenges faced by financial institutions. Its financial services CRM is tailored to manage and streamline client interactions, risk assessments, and regulatory compliance. The platform allows organizations to customize workflows to reflect the specific processes of their financial services, from loan origination to asset management.

This customization extends to data fields, views, and dashboards that can be adapted to display relevant information like client financial profiles, risk categories, and ongoing transactions. Another significant advantage of Creatio for financial services is its robust analytics and reporting features. These tools enable financial institutions to gain deep insights into customer data, helping them to predict customer needs and behaviors.

Furthermore, the platform ensures that all customer data is handled securely with data protection measures that comply with international regulations such as GDPR and industry-specific standards like PCI DSS. This helps protect sensitive financial information and build trust with clients. Additionally, Creatio's audit trails and data access controls help financial institutions maintain transparency and accountability.

CRM Creatio Standout Features and Integrations

Features include a 360-degree customer view of profiles and interactions, end-to-end workflow automation, no-code customization, a drag-and-drop interface for automation, KPI monitoring tools, custom dashboards, collaboration tools, mobile access, privacy controls, and more.

Integrations include Asterisk, Calendly, Chat Master, Jira, Microsoft Teams, PandaDoc, Quickbooks, SAP BusinessOne, SharePoint, Shopify, Zoom, Zapier, and more.

Pros and cons

Pros:

- Data security and privacy features

- Automation capabilities

- Customizable features

Cons:

- May be expensive to access all modules

- Learning curve for new users

HubSpot CRM is a customer relationship management platform with features that support sales, marketing, and customer service efforts. It has features for deal management, appointment booking, and client email and communications tracking.

Why I picked HubSpot CRM: This platform is great not only because of its comprehensive CRM feature suite, but also because it's available as a freemium offer. The free-forever version boasts core CRM functionality and a user-friendly interface. Users can manage up to 1,000,000 contact records, plus unlimited customer data.

Businesses in the financial services industry will benefit from the software's meeting scheduling feature and client communication tools. Client histories and contact info are stored in a shared space, meaning anyone from your team can jump in and offer a contextual, personalized experience for that client.

HubSpot CRM Standout Features and Integrations

Features include contact, deal, and task management; email tracking and engagement notifications; email templates and scheduling; document sharing; meeting scheduling; live chat; and sales quotes.

Integrations include Gmail, Outlook, Google Calendar, Office 365, and Slack. A paid Zapier subscription unlocks additional integrations.

Pros and cons

Pros:

- Generous freemium plan

- Sales, marketing, and service features

- Friendly and easy to learn

Cons:

- May offer broader functionality than needed

- Limited customizability with free plan

Zoho CRM is a comprehensive customer relationship management software that caters to various industries, including financial services. It provides tools to manage client relationships, streamline operations, and enhance productivity. Financial advisors, wealth managers, and insurance agents can utilize Zoho CRM to manage client portfolios, track interactions, and ensure compliance with industry regulations.

Why I Picked Zoho CRM: Zoho CRM stands out for its industry-specific features designed to meet the unique needs of financial professionals. The software includes tools for client onboarding, risk assessment, and compliance management, ensuring that all regulatory requirements are met at every stage of the customer journey. Additionally, Zoho CRM offers a comprehensive view of client portfolios, helping advisors provide personalized services.

Additionally, Zoho CRM's advanced analytics and reporting tools are particularly beneficial for financial services. These features provide insights into client behaviors, investment patterns, and market trends, allowing advisors to make informed decisions. The CRM's workflow automation capabilities streamline routine tasks such as follow-ups and document management, freeing up time for financial advisors to focus on building client relationships.

Zoho CRM also offers multi-channel communication tools that enable advisors to connect with clients through various platforms. Customization options include custom modules, fields, and layouts that enable firms to create a CRM environment that aligns with their workflow and business processes.

Zoho CRM Standout Features and Integrations

Features include client onboarding, compliance management, portfolio management, secure data handling, advanced analytics, workflow automation, multi-channel communication, AI-powered insights, custom modules, and document management.

Integrations include Zoho Books, QuickBooks, Microsoft Office 365, Google Workspace, Slack, Mailchimp, Zapier, LinkedIn, DocuSign, Xero, and Salesforce.

Pros and cons

Pros:

- Highly customizable CRM

- Robust report generation features

- CRM is accessible on mobile devices

Cons:

- Set up can be time consuming

- Extensive features can present a learning curve

Built on Salesforce, Practifi is a CRM for finance service providers and wealth management firms that includes automated workflows, client management, compliance, reporting, and advanced analytics.

Why I picked Practifi: With rising cybersecurity threats and data breaches, wealth management firms need a solution to protect their tech stack and client data. Practifi Protect is one such solution that will help you manage compliance obligations and protect your data. It provides enterprise-level data encryption, event monitoring, and field audit history, which protects users' data from unauthorized access.

Practifi offers a customizable dashboard and reporting system that allows advisors to track critical metrics and gain insights into their business operations. Users can tailor the dashboard to display the most relevant data, including interactive charts and graphs.

Practifi's workflow automation tools help streamline routine tasks, such as onboarding new clients, managing client reviews, and tracking compliance obligations. This saves time and reduces the likelihood of errors while also freeing up time that advisors can use to focus on delivering high-quality service to their clients.

Practifi Standout Features and Integrations

Features include automation, pre-built workflows, pipeline tracking, centers of influence (COI), compliance management, enterprise workflow engine, analytics and reporting, open API, Salesforce AppExchange, and mobile app.

Integrations include Addepar, Bento Engine, Black Diamond, Constant Contact, Egnyte, Envestnet, Microsoft 365, PreciseFP, Quik, Schwab Advisor Center, and other software options.

Pros and cons

Pros:

- Good reporting and analytics features

- Centralized hub for client data

- Automates routine tasks

Cons:

- Limited customization options

- Limited mobile functionality

Act! helps small and medium-sized businesses manage sales pipelines, schedule appointments, track customer interactions, and automate marketing campaigns.

Why I picked Act!: The CRM platform acts as a repository of all your client and contact information. It stores lead interactions, activities, contact details of leads, and account history. Act! also provides advanced search and filtering capabilities, allowing users to find specific contacts based on various criteria quickly.

Users can also segment their contacts into groups based on shared characteristics or interests, making it easier to target specific customer groups with tailored marketing messages. Additionally, it offers both on-premise and cloud-based hosting.

Act! Standout Features and Integrations

Features include marketing automation, rich account management, calendar and activity tracking, dynamic sales pipeline management, analytics, mobile app, data import tool, and technical support.

Integrations include Google Contacts, Slack, Eventbrite, SurveyMonkey, Wufoo, BigCommerce, Shopify, Volusion, Ecwid, Instagram, and other software options.

Pros and cons

Pros:

- Mobile access available

- Affordable pricing plans

- Good customer support

Cons:

- It may not be suitable for larger organizations

- Limited scalability

Best for businesses that require a wide array of customizations

Salesforce is a leading customer relationship management (CRM) vendor. The Salesforce Financial Services Cloud, specifically, is tailored for financial advisors and firms to manage client relationships and data.

Why I picked Salesforce Financial Services Cloud: The software integrates with Salesforce Einstein, which is an artificial intelligence platform. With Salesforce Einstein, you will better understand your clients' behavior and preferences. Further, you can use the platform's predictive modeling and forecasting capabilities to identify trends and patterns in client data.

Salesforce Financial Services Cloud helps companies manage their clients' financial needs. One of the primary reasons why the tool is a popular CRM solution for financial services companies is its customizability. Financial advisors can tailor the platform to their needs, creating workflows and dashboards that fit their unique business processes.

Another critical factor that makes Salesforce Financial Services Cloud effective for financial advisors is its integration capabilities. The platform can integrate with various other systems, such as financial planning and back-office systems, enabling advisors to access critical information and insights in one central location.

Salesforce Financial Services Cloud Standout Features and Integrations

Features include client and household management, financial account management, collaboration tools, compliance and security, mobile app, analytics and reporting, lead and referral management, and customization.

Integrations include Salesforce Sales Cloud, Quickbooks, Xero, SAP Concur, Sage Intacct, Workato, FinancialForce Accounting, Chargent, and other software options.

Pros and cons

Pros:

- Extensive integrations

- Wide range of customizations

- Provides robust analytics

Cons:

- Implementation requires technical expertise

- Steep learning curve

Irwin provides cloud-based financial CRM software to help businesses find new investors, record interactions, and manage their investor base.

Why I picked Irwin: The investor intelligence and monitoring features provide a complete overview of your investors. The monitoring feature lets you set up alerts for specific stocks or assets. These alerts can be based on price changes, news articles, earnings reports, and other metrics.

With the help of investor intelligence and monitoring, investor targeting, and an email management system, Irwin will help you better manage your investor interactions.

Irwin Standout Features and Integrations

Features include permissions, activity dashboard, activity tracking, client portal, contact management, customer database, customizable reports, data import/export, data visualization, email marketing, financial analysis, financial management, and interaction tracking.

Integrations include Google Calendar, Gmail, and Outlook Calendar.

Pros and cons

Pros:

- Regularly updates the database

- Provides insights about investor behavior

- Integrates with Gmail and Outlook

Cons:

- Some users found the interface complicated

- Some reporting features lack automation

Centrex Software is a finance CRM for businesses and consumer finance companies that need help managing their finances.

Why I picked Centrex Software: The software comprises advanced analytics capabilities that provide users with real-time insights into their business. It also includes customizable templates and advanced filtering options that help users create and share detailed reports.

In addition, Centrex Software offers opportunity management features that help users manage their sales pipeline and convert potential customers into paying customers. For example, the sales pipeline management feature allows users to track the status of their sales opportunities and move them through different stages of the sales pipeline.

The lead and contact management feature enables businesses to store and manage all their leads and contacts in one centralized location. Users also get access to a range of sales forecasting tools and capabilities, allowing them to predict future sales performance and identify areas for improvement.

Centrex Software Standout Features and Integrations

Features include ClixSign, lender matchmaking, text and email marketing, client portal, contact and deal management, broker/ISO management, and software security.

Integrations include ACH Processors, Plaid, Xactis, Bluerock, Twilio, SuperVest, SnowFlake, Thomson Reuters, Spinify, and other software options.

Pros and cons

Pros:

- It provides several customization features

- Flexible and scalable solution

- Good customer support

Cons:

- Occasional downtimes

- ClixSign needs improvement

Best for independent financial advisors and wealth management professionals

Wealthbox provides contact, project, and pipeline management tools to small businesses and financial advisors.

Why I picked Wealthbox CRM: The software's dashboard is customizable, providing a clear view of important information, tasks, and client data. Also, it integrates with popular financial planning and investment management tools.

Wealthbox CRM emphasizes collaboration and teamwork, allowing users to assign tasks, share documents, and communicate in real-time. In addition, it provides advanced security features to protect sensitive client information and ensure compliance with industry regulations. The software includes SSL encryption, two-factor authentication, and other security measures to keep data safe.

Wealthbox CRM Standout Features and Integrations

Features include contact management, Wealthbox mail, task management, activity streams, automated workflows, calendar, opportunity tracking, file storage, advanced reports, mobile, security, and administrative controls.

Integrations include AdvicePay, Apple Calendar, Altruist, Asana, AssetBook, AWeber, Axos, Betterment, Blueleaf, Black Diamond, and other software options.

Pros and cons

Pros:

- Easy onboarding

- Intuitive interface

- Extensive integrations

Cons:

- Limited customizations

- Workflows can be more visually appealing

Other Financial Services CRM Software

Here are a few more options that didn’t make the best financial services CRM software list:

Related Financial Services CRM Software Reviews

If you still haven't found what you're looking for here, check out these tools closely related to financial services CRM software that we've tested and evaluated.

- CRM Software

- Sales Software

- Lead Management Software

- Business Intelligence Software

- Contract Management Software

- Revenue Management System

Selection Criteria For Financial Services CRM Software

Selecting the right financial services CRM software is a critical decision that hinges on the software’s ability to meet specific functionality and use case demands. From my extensive personal experience testing and researching various financial services CRM platforms, I have developed a thorough criterion-based evaluation process. This process focuses on both core functionalities and additional features that differentiate the best solutions in the market, aiming to address specific buyer needs, solve pain points, and enhance revenue operations.

Core Financial Services CRM Software Functionality: 25% of total weighting score

To be considered for inclusion on my list of the best financial services CRM platforms, a solution had to support the ability to fulfill common use cases:

- Comprehensive client data management

- Efficient lead tracking and conversion

- Seamless regulatory compliance and reporting

- Targeted marketing campaign management

- Effective case and query resolution

Additional Standout Features: 25% of total weighting score

- Platforms introducing machine learning algorithms for predictive analytics and customer insights

- Solutions integrating advanced security features like biometric access and end-to-end encryption

- Tools offering advanced customization and scalability options for growing financial enterprises

- Systems providing real-time collaboration tools for team communication and client interaction

- Platforms with integrated financial planning and advisory modules

Usability: 10% of total weighting score

- Solutions offering intuitive interfaces that allow users to navigate complex financial data easily

- Platforms where key functionalities are accessible via simple, user-friendly dashboards

- Systems designed with mobile-first approaches, ensuring usability across devices

Onboarding: 10% of total weighting score

- Platforms that include comprehensive onboarding tools such as video tutorials, setup wizards, and FAQs

- Solutions offering live onboarding support through webinars, one-on-one sessions, or interactive guides

- Systems that provide customizable onboarding pathways, allowing users to choose learning styles that best suit their pace and preferences

Customer Support: 10% of total weighting score

- Evaluation of responsiveness and problem-solving efficiency across support channels (phone, email, live chat)

- Availability of 24/7 customer support and emergency troubleshooting

- Assessment of dedicated support representatives for enterprise accounts

Value For Money: 10% of total weighting score

- Analysis of pricing tiers versus features offered, assessing whether higher costs are justified by advanced functionalities

- Comparison of contract flexibility, looking for cancellation terms and scalability options without excessive fees

- Evaluation of transparency in pricing without hidden costs for add-ons and upgrades

Customer Reviews: 10% of total weighting score

- Investigating feedback trends to gauge user satisfaction and software reliability

- Analysis of testimonials on user interface intuitiveness and feature utility

- Reviewing customer comments on the effectiveness of customer support and ongoing software maintenance

By closely examining each criterion, buyers can ensure that they choose a platform that not only meets their immediate needs but also scales with their business growth and adapts to evolving market conditions. This methodical approach aids in selecting a tool that will robustly support and propel their financial operations.

Trends In Financial Services CRM Software For 2024

Innovations in CRM platforms are primarily driven by the demand for enhanced efficiency, deeper analytical insights, and heightened security in managing revenue operations. These developments reflect the sector's move towards more integrated, user-focused, and compliance-oriented solutions that can offer a competitive edge in a tight market.

Evolving Technology and Features

Integration of AI and Machine Learning:

- AI technologies are increasingly incorporated to automate data entry, predict customer behaviors, and offer personalized financial advice, reflecting the industry's shift towards more proactive and customer-centric service models.

Enhanced Security Measures:

- Given the sensitive nature of financial data, CRM systems are rapidly evolving to include advanced encryption methods, biometric authentication, and real-time fraud detection mechanisms, ensuring that customer data is protected against evolving cyber threats.

Novel Functionality

Regulatory Compliance Automation:

- One of the most novel features in recent updates includes automated tools for managing and staying ahead of regulatory compliance, crucial as global financial regulations become more stringent and complex.

Core Features in Demand

Robust Analytics and Reporting Tools:

- There is a significant demand for advanced analytics capabilities that allow firms to harness large volumes of data for better decision-making and personalized customer experiences.

Multi-channel Communication Coordination:

- Efficiently managing communications across various channels remains highly demanded to ensure consistent and effective customer interactions.

Declining Features

Basic Task Automation:

- As the technology matures, basic automation features that handle simple tasks are becoming less emphasized, replaced by demand for deeper AI integration that provides significant strategic value beyond mere automation.

This shift in financial services CRM software is closely aligned with the needs of revenue operation leaders who require tools that not only simplify daily tasks but also provide strategic insights and ensure compliance with ever-changing regulations. The ongoing trend toward sophisticated, integrated CRM solutions demonstrates the industry's commitment to leveraging technology to enhance client relationships and operational efficiency.

What Is Financial Services CRM Software?

Financial services CRM software is a specialized tool used by financial institutions to manage and enhance relationships with their clients. It integrates traditional CRM functionalities with features specifically tailored for the financial sector, such as client account management, compliance tracking, and financial product and service tracking. This software is essential for banks, investment firms, insurance companies, and other financial service providers to handle client interactions, manage portfolios, and adhere to industry-specific regulations.

The benefits of financial services CRM software include improved client relationship management, offering personalized financial advice and services. It streamlines operations, reducing administrative workload and increasing efficiency. The software aids in maintaining regulatory compliance and managing risks associated with client portfolios. Additionally, it provides insights into client behavior and preferences, supporting more effective marketing and sales strategies. Overall, financial services CRM software enhances the quality of customer service and supports the strategic growth of financial institutions.

Features Of Financial Services CRM Software

Financial services CRM software needs to align with industry-specific requirements including compliance, client management, and complex financial product handling. Based on my experience and insights into financial services, here are the key features to look for that support effective revenue operations management.

- Comprehensive Client Profiling: Enables detailed tracking of client information and financial activities. This feature is essential for personalizing client interactions and offering tailored financial solutions.

- Advanced Analytics and Reporting: Provides deep insights into customer behavior, sales performance, and market trends. These analytics are crucial for making informed strategic decisions and optimizing revenue operations.

- Regulatory Compliance Management: Automates and monitors compliance with local and international regulations. This functionality ensures that financial services operate within legal frameworks, avoiding penalties and reputational damage.

- Multi-Channel Communication: Facilitates seamless communication across email, phone, and digital channels. Keeping all client communications integrated and accessible is key to maintaining strong customer relationships.

- Workflow Automation: Streamlines complex processes such as approvals, risk assessments, and onboarding. Automation increases operational efficiency and reduces the chance of human error.

- Performance Management Tools: Tracks and analyzes individual and team performance against set targets. Effective performance management is vital for driving sales and improving service delivery.

- Robust Security Features: Protects sensitive financial data with encryption, access controls, and secure data storage. High-level security is non-negotiable in maintaining trust and safeguarding against data breaches.

- Flexible Integration Capabilities: Easily integrates with other business systems like banking software, ERP, and data management tools. Integration is critical for ensuring that all systems work together smoothly, providing a cohesive view of operations.

- Customer Service Management: Manages inquiries, complaints, and service requests efficiently. Excellent customer service management helps retain clients and enhances reputation.

- Scalability: Adapts to the growth of the business in terms of data volume and transaction complexity. A scalable CRM supports expansion without performance degradation.

Selecting a financial services CRM with these features will ensure that your revenue operations are managed effectively, aligning with both customer expectations and regulatory standards. This approach not only optimizes operations but also drives sustainable growth and customer satisfaction in the competitive financial services sector.

Benefits Of Financial Services CRM Software

Financial services CRM software offers a suite of tools designed to streamline the complexities of managing client relationships and operational processes in the financial sector. These systems provide significant benefits by enhancing efficiency, compliance, and customer satisfaction. For organizations looking to optimize their revenue operations, understanding the primary benefits of this software can guide a more informed decision-making process.

- Enhanced Customer Relationship Management: Builds and maintains robust client relationships through improved communication and service delivery. This benefit is critical as it directly influences client retention and satisfaction, which are pivotal for long-term business success.

- Increased Operational Efficiency: Automates routine administrative tasks and streamlines complex workflows. The automation reduces manual effort and errors, allowing staff to focus on more strategic activities that drive business growth.

- Comprehensive Compliance Management: Ensures adherence to regulatory requirements with automated tracking and reporting tools. This feature mitigates the risk of compliance breaches, which can result in hefty fines and damage to reputation.

- In-Depth Analytics and Reporting: Offers valuable insights into client behavior, financial trends, and business performance. These analytics empower businesses to make data-driven decisions that enhance their strategic planning and market responsiveness.

- Scalability: Adapts to a growing client base and an increasing volume of transactions without losing performance. Scalability is essential for financial institutions aiming to expand their market reach and service offerings without compromising on service quality.

Costs & Pricing For Financial Services CRM Software

Selecting the right financial services CRM software involves understanding the various plan options and their associated costs. These plans are typically structured to accommodate businesses of different sizes and needs, ranging from basic offerings for small firms to more advanced solutions for large enterprises. Below, I've outlined common pricing tiers and features to help potential buyers discern which option might suit their organization best.

Plan Comparison Table For Financial Services CRM Software

| Plan Type | Average Price | Common Features Included |

|---|---|---|

| Basic | $50-100/user/month | Client management, basic reporting, email integration |

| Professional | $100-200/user/month | Enhanced analytics, compliance tools, advanced automation |

| Enterprise | $200-500/user/month | Custom reports, API access, dedicated support, multi-layer security |

| Free | $0 | Limited client management, basic analytics |

When considering these options, weigh the specific needs of your business against the features and support offered at each tier. It's important to choose a plan that not only fits your current requirements but also has the capacity to scale as your business grows. This strategic approach ensures you invest in a solution that supports both immediate and future needs effectively.

Financial Services CRM Software Frequently Asked Questions

Here are a few popular questions answered for your convenience!

What is the importance of a CRM in marketing financial services?

Can a CRM track real-time customer interactions?

How does a CRM impact client retention?

What CRM features aid in regulatory compliance?

What other financial services software should I use?

Conclusion

The success of financial services companies relies on their ability to manage leads, onboard clients, and close sales efficiently. This is where implementing top-notch customer relationship management (CRM) software comes in handy.

With a plethora of options available, choosing the right CRM tool for your business can be overwhelming. However, the list of financial services CRM highlighted in this article provides a great starting point to find a solution that fits your needs.

If you enjoyed this article and want more tips and insights about revenue operations, subscribe to our newsletter.