Best CRM Software For Financial Advisors Shortlist

Here's my pick of the 10 best software from the 20 tools reviewed.

Our one-on-one guidance will help you find the perfect fit.

CRM software for financial advisors is a valuable asset for any company. With the right software, teams can better manage client relationships and improve workflow efficiency. However, finding the right CRM software for financial advisors can be challenging, especially with so many available options.

Using my experience with business management software, I tested and compared several of the top CRM software available for financial advisors. From there, I compiled my results into in-depth reviews to help you find the best software for your unique needs. I’m confident you’ll discover your next CRM software for financial advisors in the list below.

Why Trust Our Software Reviews

We’ve been testing and reviewing CRM software since 2022. As revenue operations experts ourselves, we know how critical and difficult it is to make the right decision when selecting software. We invest in deep research to help our audience make better software purchasing decisions.

We’ve tested more than 2,000 tools for different Revenue Operations use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our software review methodology.

Best CRM Software For Financial Advisors Summary

| Tools | Price | |

|---|---|---|

| Keap | From $249/user/month (billed annually) | Website |

| Redtail CRM | From $39/user/month (billed annually) | Website |

| Wealthbox CRM | From $45/user/month | Website |

| Maximizer CRM | From $65/user/month (min 3 users) | Website |

| Advyzon | Pricing upon request | Website |

| Freshworks CRM | From $9/user/month (billed annually) | Website |

| Concenter Services (XLR8 CRM) | From $80/user/month | Website |

| Equisoft | From $74/month | Website |

| AdvisorEngine | Pricing upon request | Website |

| SmartOffice | Pricing upon request | Website |

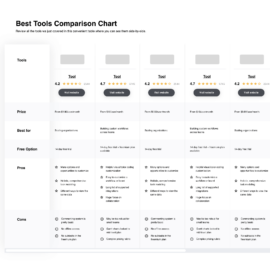

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareHow To Choose CRM Software For Financial Advisors

It’s easy to get bogged down in long feature lists and complex pricing structures. Here's a checklist of factors to remember to help you stay focused as you work through your unique software selection process.

| Factor | What to Consider |

| Scalability | Will this software grow with your firm as it expands? |

| Integrations | Does it integrate with the tools your team already uses? |

| Customizability | Can you tailor the software to fit your firm's processes? |

| Ease of Use | Is the interface user-friendly for your team? |

| Budget | Does the pricing fit within your firm’s financial plan? |

| Security Safeguards | Does the software meet your data security requirements? |

| Support Options | What kind of customer support will you have access to? |

| Compliance | Does it comply with regulations relevant to your industry? |

Best CRM Software For Financial Advisors Reviews

Below are my detailed summaries of the best CRM software for financial advisors that made it onto my shortlist. My reviews offer a detailed look at each tool’s key features, pros and cons, integrations, and ideal use cases to help you find the best one for you.

Keap (formerly Infusionsoft) is an all-in-one platform that helps businesses manage customer relationships, sales, and marketing tasks. It combines CRM tools with automation features, enabling users to streamline their marketing efforts and stay organized. The platform is designed to support small businesses and teams looking for an easy way to manage customer interactions and automate repetitive tasks.

Why I Picked Keap:

Keap offers powerful marketing automation tools that help you set up email campaigns, manage leads, and track customer interactions. You can create personalized workflows to automate follow-ups, lead nurturing, and client engagement. Its drag-and-drop interface simplifies building automated sequences, allowing your team to focus on strategic tasks. Keap also integrates contact management with marketing, keeping all your customer data in one place for easy access and tracking.

Standout Features & Integrations:

Features include marketing automation, lead management, and appointment scheduling. You can create automated email sequences and follow-ups to engage with leads and customers efficiently. The platform also includes tools for managing contacts and tracking sales, making it easier for your team to stay organized.

Integrations include QuickBooks, Zapier, Gmail, Outlook, Stripe, PayPal, WooCommerce, Shopify, WordPress, and Leadpages.

Pros and cons

Pros:

- Scales well with business growth

- Customizable email workflows

- Strong marketing automation capabilities

Cons:

- Can be overwhelming for small teams

- Limited flexibility in sales pipelines

Redtail CRM is a cloud-based solution designed to help financial professionals manage client relationships and day-to-day operations. It offers tools for organizing client data, tracking tasks, and handling communications in one central hub. The platform is tailored to make team client management more efficient.

Why I Picked Redtail CRM:

Redtail offers built-in automated reminders that ensure you never miss important client interactions. You can set reminders for tasks, appointments, and follow-ups, helping you stay organized. The software's workflow automation also assists with tracking client touchpoints, reducing the need for manual oversight. Redtail's task management features help your team stay on top of their to-dos with minimal effort, making it a solid option for firms needing automated support.

Standout Features & Integrations:

Features include automated reminders, task management, and workflow automation. You can set reminders for follow-ups and client meetings, ensuring your team stays on track. The platform also helps organize client data efficiently, reducing the need for manual task oversight.

Integrations include Riskalyze, Morningstar, Albridge, MoneyGuidePro, Orion, Wealthbox, Salesforce, Black Diamond, Laser App, and eMoney.

Pros and cons

Pros:

- Customizable workflows for teams

- Scalable for growing firms

- Strong task automation features

Cons:

- Complex learning curve for new users

- Limited reporting customization options

Wealthbox CRM is a cloud-based platform designed for financial professionals to manage their client relationships and day-to-day business operations. It offers tools for tracking client interactions, managing tasks, and streamlining workflows, making it easy for teams to stay organized and efficient.

Why I Picked Wealthbox CRM:

Wealthbox CRM includes collaboration features that allow teams to share updates, notes, and tasks effortlessly. Your team can communicate within the platform and assign tasks to ensure everyone stays on the same page.

It also offers a timeline feature, where all activities and interactions are visible to everyone on the team. This makes it ideal for firms that need a more collaborative approach to managing their client relationships and internal communications.

Standout Features & Integrations:

Features include team collaboration tools, task management, and a timeline view for tracking client interactions. You can assign tasks to team members and share notes to keep everyone aligned on client updates. The platform’s timeline feature gives your team full visibility into all client activities.

Integrations include AdvicePay, Apple Calendar, Altruist, Asana, AssetBook, AWeber, Axos, Betterment, Blueleaf, and Black Diamond.

Pros and cons

Pros:

- Minimal technical knowledge required

- Quick onboarding process

- Great for team collaboration

Cons:

- Lacks advanced reporting features

- Limited customizability for workflows

Maximizer CRM is a business management solution that offers tools to manage client relationships and track business performance. It's designed for professionals handling client data, sales, and reporting in one platform. The software is ideal for firms that need flexible tools to manage their day-to-day operations.

Why I Picked Maximizer CRM:

Maximizer CRM offers flexible deployment options, making it accessible for small firms that need on-premise or cloud-based solutions. You can customize the software to match your team’s workflow, which helps simplify operations.

The platform includes features like opportunity tracking, email campaigns, and performance reporting that are easy to tailor for smaller firms. Maximizer also offers data management tools so your team can handle client information efficiently without being overwhelmed by excessive features.

Standout Features & Integrations:

Features include opportunity tracking, performance reporting, and customizable dashboards. To stay in touch with clients, you can easily create and manage email campaigns. The system also offers flexible deployment options, letting you choose between on-premise or cloud-based solutions.

Integrations include Microsoft Outlook, QuickBooks, Google Workspace, Microsoft 365, Zapier, Mailchimp, Constant Contact, Shopify, and Office 365.

Pros and cons

Pros:

- Strong data management capabilities

- Flexible opportunity tracking

- Scalable deployment options

Cons:

- Not ideal for large firms

- Limited mobile functionality

Advyzon is a cloud-based platform designed to simplify financial professionals' business operations. It offers tools for managing portfolios, performance reporting, and financial planning. This solution helps users consolidate many tasks into a single, user-friendly system.

Why I Picked Advyzon:

Advyzon provides an all-in-one platform that combines portfolio management, client reporting, and document storage in one place. You can create detailed financial plans and run performance reports without needing multiple systems. Its customizable dashboards allow you to tailor the platform to fit your firm’s needs. The system also includes billing tools, making tracking and managing client payments easier.

Standout Features & Integrations:

Features include customizable performance reporting, client portal access, and billing tools. Within the same platform, you can manage client portfolios and generate detailed financial plans. The document storage system helps you keep everything organized and easily accessible.

Integrations include Morningstar, Riskalyze, Orion, TD Ameritrade, Fidelity, Redtail, Black Diamond, eMoney, Schwab, and MoneyGuidePro.

Pros and cons

Pros:

- Scalable for growing firms

- Efficient billing and invoicing tools

- Strong document storage system

Cons:

- Limited mobile app functionality

- Long onboarding process

Freshsales is a CRM solution designed to help businesses manage customer relationships and sales processes. It provides tools for tracking leads, managing deals, and automating workflows, making it ideal for teams that want to simplify their sales pipeline management.

Why I Picked Freshsales:

Freshsales offers a straightforward approach to managing sales pipelines, allowing your team to track leads and close deals easily. The drag-and-drop pipeline view helps you visualize the sales process at a glance. Its deal management tools are simple to set up, ensuring your team can quickly organize and prioritize leads. Freshsales also includes workflow automation features, reducing the need for manual follow-ups and task tracking.

Standout Features & Integrations:

Features include deal management, lead scoring, and workflow automation. A drag-and-drop interface allows you to visualize your sales pipeline easily, helping your team track progress. The platform also allows you to automate tasks like sending follow-up emails and assigning leads.

Integrations include Google Workspace, Microsoft 365, QuickBooks, Slack, Mailchimp, Docusign, Zoom, Twilio, Stripe, and Shopify.

Pros and cons

Pros:

- Strong automation for repetitive tasks

- Simple customization for sales pipelines

- Quick and easy onboarding process

Cons:

- Complex workflows need technical setup

- Limited advanced reporting options

XLR8 CRM is a solution built on the Salesforce platform, tailored to the needs of financial professionals. It provides tools for managing client relationships, tracking business processes, and streamlining compliance tasks. This system is designed to work within the Salesforce ecosystem, offering financial advisors an integrated experience.

Why I Picked XLR8 CRM:

XLR8 CRM is ideal for teams already using Salesforce, offering smooth integration and familiar workflows. You can use Salesforce’s features while using XLR8’s tailored tools for managing financial clients. The software supports compliance tracking, client data management, and automated workflows to keep your team organized.

Standout Features & Integrations:

Features include compliance tracking, customizable workflows, and client data management. You can automate tasks and processes to ensure your team meets essential deadlines. The platform also offers flexible reporting tools to help you analyze business performance effectively.

Integrations include Salesforce, Riskalyze, Laser App, MoneyGuidePro, eMoney, Orion, Albridge, Morningstar, and TD Ameritrade.

Pros and cons

Pros:

- Strong compliance tracking tools

- Customizable workflows for financial firms

- Built on familiar Salesforce platform

Cons:

- Complex implementation process

- Limited mobile functionality

Equisoft (formerly Grendal CRM) is a software solution designed to help financial professionals manage their clients and business processes efficiently. It offers tools for handling client data, documentation, and reporting, making it a practical choice for firms looking to stay organized and compliant.

Why I Picked Equisoft:

Equisoft integrates client portals, allowing clients to access their financial information directly. You can easily and securely share reports, files, and other documents, reducing the need for back-and-forth communication. The platform also features customizable workflows, letting you manage tasks more effectively.

Standout Features & Integrations:

Features include client portal access, customizable workflows, and document management. The portal allows you to share reports and files with clients securely, and the platform also supports electronic signatures to streamline document approval.

Integrations include Albridge, Morningstar, Redtail, TD Ameritrade, Pershing, Fidelity, Riskalyze, Microsoft Outlook, and Laserfiche.

Pros and cons

Pros:

- Strong document management features

- Scalable for growing firms

- Customizable client portal access

Cons:

- Limited mobile functionality

- Steep learning curve initially

AdvisorEngine CRM is a CRM solution designed for financial professionals. It offers tools to manage client relationships and daily operations. It helps firms with client communication, workflow automation, and document management, ensuring that essential processes are tracked and organized efficiently.

Why I Picked AdvisorEngine CRM:

AdvisorEngine CRM is ideal for firms needing solid compliance tracking features. It provides built-in tools to document and manage all client interactions, helping you stay audit-ready. You can automate workflows to ensure that compliance-related tasks are completed on time. The platform's document management system supports compliance by securely storing and organizing client files.

Standout Features & Integrations:

Features include automated workflows, compliance tracking, and document management. You can track all client interactions and ensure your team meets regulatory requirements. The system also helps you organize and securely store client files for easy retrieval.

Integrations include Schwab, Fidelity, TD Ameritrade, Pershing, Riskalyze, MoneyGuidePro, eMoney, Morningstar, and Orion.

Pros and cons

Pros:

- Scalable for mid-sized firms

- Customizable workflows for processes

- Strong compliance tracking tools

Cons:

- Requires time for full customization

- Steep learning curve initially

SmartOffice is a business management tool designed for financial professionals. It helps users manage client information, track sales, and handle insurance-related tasks all in one place. This solution is built to simplify day-to-day operations and ensure better organization.

Why I picked SmartOffice:

SmartOffice is tailored for professionals who handle both financial and insurance needs. You can manage insurance policies alongside client portfolios, making it easy to keep everything in one system. The software includes features like policy tracking, sales management, and automated task reminders. Its insurance-focused tools let you quickly generate reports and stay compliant with industry standards.

Standout Features & Integrations:

Features include policy tracking for insurance management, automated task reminders, and sales tracking. You can generate detailed reports to help you stay compliant with industry regulations. The software also enables you to manage financial and insurance-related data in one centralized system.

Integrations include Laser App, DTCC, SunGard, Albridge, Wealthscape, Redtail, Morningstar, SmartOffice Pro, and Salesforce.

Pros and cons

Pros:

- Efficient task automation features

- Scalable for larger firms

- Highly customizable workflows

Cons:

- Outdated user interface design

- Complex setup process

Other CRM Software For Financial Advisors

Here are some additional CRM software options that didn’t make it onto my shortlist, but are still worth checking out.

- CRM Creatio

For 360-degree client insights

- Zoho CRM

For global financial advisors

- Pipedrive

For lead management simplicity

- Salesforce CRM

For enterprise-level scalability

- Bitrix24

For built-in communication tools

- Nimble

For social media integrations

- HubSpot CRM

For inbound marketing integration

- monday.com sales CRM

For visual project management

- Agile CRM

For small business automation

- Copper CRM

For Google Workspace users

CRM Software For Financial Advisors Selection Criteria

When selecting the best CRM software for financial advisors to include in this list, I considered everyday buyer needs and pain points like managing client data efficiently and ensuring compliance with industry regulations. I also used the following framework to keep my evaluation structured and fair.

Core Functionality (25% of total weighting score)

To be considered for inclusion in this list, each solution had to fulfill these common use cases:

- Manage client contacts and profiles

- Track and automate client communications

- Provide task and appointment scheduling

- Generate client reports and dashboards

- Ensure data security and compliance

Additional Standout Features (25% of total weighting score)

To help further narrow down the competition, I also looked for unique features, such as:

- Customizable client portals

- Advanced compliance tracking

- Integration with financial planning tools

- Workflow automation for lead management

- AI-driven insights for client engagement

Usability (10% of total weighting score)

To get a sense of the usability of each system, I considered the following:

- Ease of navigation across the platform

- Intuitive user interface design

- Customization options without complexity

- Clear and simple workflows

- Accessibility on different devices

Onboarding (10% of total weighting score)

To evaluate the onboarding experience for each platform, I considered the following:

- Availability of training videos and webinars

- Pre-built templates and interactive guides

- Step-by-step product tours and tutorials

- Supportive onboarding resources like chatbots

- Migration assistance for importing data

Customer Support (10% of total weighting score)

To assess each software provider’s customer support services, I considered the following:

- 24/7 availability of support channels

- Live chat and phone support options

- Access to a knowledge base or help center

- Responsiveness and resolution times

- Availability of dedicated account managers

Value For Money (10% of total weighting score)

To evaluate the value for money of each platform, I considered the following:

- Features offered at each pricing tier

- Flexibility of pricing plans and options

- Discounts for long-term subscriptions

- Cost compared to competitors in the market

- Additional fees for extra services or features

Customer Reviews (10% of total weighting score)

To get a sense of overall customer satisfaction, I considered the following when reading customer reviews:

- Common pain points or complaints

- User feedback on scalability and growth

- Positive mentions of key features

- Experiences with customer support quality

- General satisfaction with the product's reliability

Trends In CRM Software For Financial Advisors

In my research, I sourced countless product updates, press releases, and release logs from different CRM software for financial advisors vendors. Here are some of the emerging trends I’m keeping an eye on.

- AI-driven insights: More platforms use AI to deliver actionable insights about client behavior and engagement. This helps advisors predict client needs and personalize their services, improving client relationships. For example, tools like Zoho CRM now offer AI-based lead scoring.

- Client self-service tools: Vendors are adding self-service portals where clients can access their financial data, upload documents, and manage their accounts directly. This reduces advisors' administrative tasks and offers clients more convenience.

- Advanced compliance tracking: CRMs are enhancing their compliance features with increasing regulatory demands. Tools like AdvisorEngine CRM are focusing on automated compliance checks and audit trails, making it easier for advisors to stay compliant with minimal effort.

- Enhanced data visualization: More CRMs integrate customizable dashboards with advanced data visualization tools to help advisors quickly analyze trends and portfolio performance. This trend helps firms make more informed decisions at a glance.

- Integration with robo-advisors: Some CRMs are beginning to integrate with robo-advisory services, allowing advisors to manage both human and automated investment portfolios within the same platform. This combination adds versatility for firms looking to offer hybrid financial services.

What Is CRM Software For Financial Advisors?

CRM software for financial advisors is a tool that helps manage client relationships, track communications, and organize financial data. Financial advisors, wealth managers, and planners use these tools to stay organized, ensure compliance, and offer personalized services to clients.

Features like client data management, automated reminders, and compliance tracking help with maintaining strong client relationships and meeting regulatory requirements. Overall, these tools simplify daily tasks and allow advisors to focus more on client engagement and growth.

Features Of CRM Software For Financial Advisors

When selecting the best CRM for financial advisors, keep an eye out for the following key CRM features.

- Client management: Organizes client data in one place, making tracking interactions and financial details easy.

- Automated reminders: Helps ensure important follow-ups, meetings, and tasks are never missed.

- Compliance tracking: Keeps advisors in line with industry regulations by automating necessary compliance tasks.

- Document management: Stores and organizes important client documents securely for easy access and sharing.

- Customizable workflows: Allows you to tailor workflows to fit the specific needs of your advisory firm.

- Performance reporting: Generates reports on client portfolios and business metrics and conversions, giving insights into financial performance.

- Email marketing and communication tracking: Logs all client communications in one place, making it easier to maintain consistent client engagement.

- Financial planning integration: Connects with financial planning tools to streamline advice and portfolio management.

- Task management: Assigns and tracks tasks for team members to ensure everything stays on schedule.

Benefits Of CRM Software For Financial Advisors

Implementing a CRM system for the financial services industry benefits your team and your business. Here are a few you can look forward to.

- Better client relationships: Tracks all client interactions, helping you offer personalized service.

- Improved efficiency: Automates routine tasks like reminders and follow-ups, saving time for your team.

- Enhanced compliance: Monitors compliance tasks to ensure you stay aligned with industry regulations.

- Centralized data: Keeps all client information in one place, making it easier to manage and access.

- Increased team collaboration: Helps assign tasks and track progress, ensuring everyone stays on the same page.

- Stronger decision-making: Provides performance reports and insights to help you make informed business decisions.

- Better client retention: Ensures consistent communication, which leads to improved client satisfaction and retention.

Costs and Pricing Of CRM Software For Financial Advisors

Selecting customer relationship management software for financial advisors requires understanding the various pricing models and plans available. Costs vary based on features, team size, add-ons, and more. The table below summarizes standard plans, average prices, and typical features included in CRM software for financial advisors solutions.

Plan Comparison Table for CRM Software for Financial Advisors

| Plan Type | Average Price | Common Features |

| Free Plan | $0/user/ month | Basic contact management, email tracking, and limited reporting. |

| Personal Plan | $10-$25/ user/month | Task management, email tracking, customizable dashboards, and basic automation. |

| Business Plan | $30-$60/ user/month | Workflow automation, advanced reporting, compliance tracking, and integrations. |

| Enterprise Plan | $70-$150/ user/month | Custom workflows, advanced security, dedicated support, and full customization. |

CRM Software For Financial Advisors FAQs

Here are some answers to common questions about CRM software for financial advisors.

How secure is client data in CRM software for financial advisors?

CRM software for financial advisors typically includes strong security measures like encryption and user authentication to protect sensitive client data. Many systems are designed to comply with industry regulations such as GDPR and SEC guidelines. It’s important to verify each platform’s security features and ensure they meet your firm’s compliance needs.

Can CRM software integrate with financial planning tools?

Yes, many CRM platforms for financial advisors integrate with financial planning tools, making it easier to manage client portfolios and offer personalized advice. These integrations help streamline workflows by syncing data between your CRM and the financial planning software. Be sure to check the platform’s compatibility with the tools your firm already uses.

What’s the typical implementation time for CRM software?

Implementation time varies based on the complexity of the CRM and the size of your team. For smaller teams, setup might take just a few days, while larger organizations with more customization needs might require several weeks. Most vendors offer onboarding support to help with data migration and training.

Can I customize workflows in CRM software for financial advisors?

Yes, most CRM platforms offer customizable workflows tailored to the specific processes of financial advisory firms. You can automate tasks like client follow-ups, appointment scheduling, and compliance checks. Customization options vary, so it’s important to choose a platform that aligns with your firm’s operational needs.

Is CRM software scalable as my firm grows?

Most CRM solutions for financial advisors are designed to scale with your business. You can typically add users, upgrade features, and adjust workflows as your firm grows. Check whether the platform offers flexible pricing plans that can accommodate your firm’s expansion over time.

What’s Next?

Want to take your RevOps game to the next level?

Subscribe to The RevOps Team newsletter for expert advice, software reviews, and other resources to help you deliver predictable growth at scale.