10 Best Banking CRM Software Shortlist

Here’s my pick of the 10 best software from the 20 tools reviewed.

Our one-on-one guidance will help you find the perfect fit.

Banking CRM software is a valuable asset for any company. With the right software, teams can capture and store customer data, including personal information, transaction history, and communication preferences. This data enables bank representatives to converse with customers, address their specific needs, and provide tailored financial solutions.

However, finding the right banking CRM software can be challenging, especially with many available options. Using my experience with revenue operations software, I tested and compared several of the top banking CRM software available. From there, I compiled my results into in-depth reviews to help you find the best software for your unique needs. You’ll discover your next banking CRM software in the list below.

Why Trust Our Software Reviews

We’ve been testing and reviewing revenue operations software since 2022. As revenue operations experts, we know how critical and challenging it is to make the right decision when selecting software. We invest in deep research to help our audience make better software purchasing decisions.

We’ve tested more than 2,000 tools for different Revenue Operations use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our software review methodology.

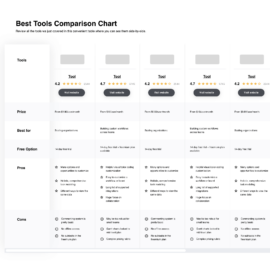

Best Banking CRM Software Summary

This comparison chart summarizes pricing details for my top banking CRM software selections, helping you find the best one for your budget and business needs.

| Tools | Price | |

|---|---|---|

| CRM Creatio | From $25/user/month | Website |

| LeadSquared | From $400/user/month (billed annually) | Website |

| Vtiger | From $12/user/month (billed annually) | Website |

| Zendesk Sell | From $19/user/month | Website |

| Freshworks CRM | From $9/user/month (billed annually) | Website |

| Equisoft | From $74/month | Website |

| Vymo | Pricing upon request | Website |

| Insightly | From $29/user/month (billed annually) | Website |

| SalesmateCRM | From $23/user/month (billed annually) | Website |

| Pipeliner CRM | From $65/user/month (billed annually) | Website |

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareHow To Choose Banking CRM Software

It’s easy to get bogged down in long feature lists and complex pricing structures. Here's a checklist of factors to remember to help you stay focused as you work through your unique software selection process.

| Factor | What to Consider |

| Scalability | Will the software grow with your business? |

| Integrations | Does it integrate with your current systems? |

| Customizability | Can you tailor it to fit your specific needs? |

| Ease of Use | Is it user-friendly for your team? |

| Budget | Is it affordable within your budget? |

| Security Safeguards | Does it meet your security requirements? |

| Support | Is there reliable customer support available? |

| Reporting Tools | Are the reporting tools solid and valuable? |

Best Banking CRM Software Reviews

Below are my detailed summaries of the best banking CRM software on my shortlist. My reviews thoroughly examine each tool’s key features, pros and cons, integrations, and ideal use cases to help you find the best one.

CRM Creatio is a no-code platform that can be tailored for a wide range of businesses, including those in the banking industry. It helps financial institutions manage customer relationships and automate workflows. It serves banks of all sizes, focusing on enhancing customer journeys and simplifying office operations.

Why I picked CRM Creatio: CRM Creatio offers specialized banking features like customer data management, marketing automation, and compliance tracking. Its no-code environment allows your team to customize workflows without needing extensive technical expertise. The platform includes solid analytics tools to provide insights into customer behavior and operational efficiency. It also supports end-to-end customer journey orchestration, ensuring seamless service delivery.

Standout features & integrations:

Features include omnichannel communication tools that enable your team to interact with customers through various channels. The platform's AI and machine learning tools analyze customer data to identify trends and predict behaviors, supporting informed decision-making. Additionally, CRM Creatio offers document management capabilities, allowing for centralized storage.

Integrations include Microsoft Outlook, Google Workspace, Docusign, Zoom, LinkedIn Sales Navigator, Twilio, Slack, QuickBooks, and Stripe.

Pros and cons

Pros:

- Supports scaling businesses

- No-code platform

- Extensive customization options

Cons:

- Data migration may be complex

- Customization can be time-consuming

LeadSquared is a lending CRM designed to help financial institutions simplify loan disbursements and improve borrower experience. It caters primarily to banks, Fintechs, and other lending institutions, focusing on enhancing team efficiency and automating the lending process.

Why I picked LeadSquared: This CRM simplifies the loan disbursement process, helping you manage borrower interactions efficiently. You can automate repetitive tasks, reducing manual errors and accelerating loan approvals. The platform also offers self-serve portals for your borrowers, making the application process straightforward and transparent. Additionally, it provides insightful analytics to help your team make data-driven decisions.

Standout features & integrations:

Features include automated loan follow-ups, workflow automation, and borrower self-serve portals. These features can reduce manual work, speed up loan approvals, and offer a better borrower experience. The platform also provides insightful analytics to aid in decision-making.

Integrations include Salesforce, HubSpot, Zapier, Workato, Google Analytics, Microsoft Dynamics, QuickBooks, Docusign, Mailchimp, and Slack.

Pros and cons

Pros:

- Self-serve borrower portals

- Efficient workflow automation

- Insightful analytics

Cons:

- Learning curve for new users

- Dependence on internet connectivity

Vtiger is a cloud-based CRM platform designed for small to medium-sized businesses. It enables sales, marketing, and customer support teams to collaborate effectively and improve customer relationships.

Why I picked Vtiger: Vtiger offers a unified view of customer information, making it easier for your team to manage interactions and track progress. The system includes features like email marketing, lead management, and ticketing to support your sales and customer service efforts. Its automation capabilities help reduce manual tasks, allowing your team to focus on more critical activities. The platform's customizable dashboards provide actionable insights to drive better decision-making.

Standout features & integrations:

Features include email marketing, lead management, and ticketing. You can automate repetitive tasks to save time, and customizable dashboards give you actionable insights.

Integrations include MailChimp, Zapier, QuickBooks, Google Workspace, Microsoft 365, Twilio, Tally, Docusign, PandaDoc, and PayPal.

Pros and cons

Pros:

- Customizable dashboards

- Unified customer view

- Automation of tasks

Cons:

- Learning curve

- Some features may be complex

Zendesk Sell is a sales CRM software designed to enhance productivity, processes, and pipeline visibility for sales teams. It's tailored for sales professionals and teams looking to eliminate friction in their sales processes and sell more effectively.

I picked Zendesk Sell: Zendesk Sell is a CRM focusing on increasing sales productivity through features like sales email automation and pipeline management. The platform offers tools for tracking and managing leads and deals, ensuring your team can prioritize their tasks. Its detailed sales reporting and analytics provide insights that help you make data-driven decisions. Additionally, the mobile app ensures that your team can access critical information and perform tasks on the go.

Standout features & integrations:

Features include sales email automation, pipeline management, and detailed sales reporting and analytics. You can track and manage leads and deals in one place, ensuring your team stays organized. The mobile app allows you to manage tasks and access information anywhere.

Integrations include Mailchimp, HubSpot, Google Calendar, Slack, Zendesk Support, Zapier, Shopify, QuickBooks, Dropbox, and Docusign.

Pros and cons

Pros:

- Mobile app access

- Sales email automation

- Pipeline management

Cons:

- Limited customization options

- Requires consistent data entry

Freshworks CRM is a customer relationship management solution for sales, marketing, and customer support teams. It helps businesses manage customer interactions, automate workflows, and gain insights through analytics.

Why I picked Freshworks CRM: Freshworks CRM offers a unified platform for managing customer interactions across different channels. It includes lead scoring, sales pipeline management, and customer support ticketing. The software’s intuitive interface makes it easy for your team to adopt and use it immediately. Additionally, built-in analytics provide actionable insights to improve your business processes.

Standout features & integrations:

Features include lead scoring to prioritize your sales efforts, visual sales pipelines to track deals, and integrated customer support tools to manage tickets. You can also benefit from customizable dashboards that provide real-time insights into your business performance.

Integrations include Google Workspace, Microsoft 365, Mailchimp, Zapier, Slack, Shopify, QuickBooks, Xero, Stripe, and PayPal.

Pros and cons

Pros:

- Easy to set up

- Customizable dashboards

- Integrated ticketing system

Cons:

- Limited customization options

- Occasional slow performance

Equisoft is a CRM software tailored for financial advisors, primarily serving the insurance and wealth management sectors. It facilitates customer relationship management, compliance, and detailed financial planning.

Why I picked Equisoft: Equisoft provides features like customer relationship management, compliance management, and financial planning tools. It helps you manage your clients' data efficiently and ensures you meet industry regulations. The platform also supports in-depth financial analysis to help you create credible client plans. This allows your team to focus more on building relationships rather than getting bogged down with administrative tasks.

Standout features & integrations:

Features include compliance management, customer relationship management, and financial planning. You can easily manage your client data and ensure all industry regulations are met. The financial planning tools help you create detailed and credible plans for your clients.

Integrations include Salesforce, Microsoft Dynamics 365, Oracle, SAP, HubSpot, Zoho CRM, Pipedrive, NetSuite, QuickBooks, and Xero.

Pros and cons

Pros:

- Customizable dashboard

- In-depth financial analysis

- Efficient client data management

Cons:

- Steep learning curve

- Limited mobile functionality

Vymo is a sales and distribution management platform for financial institutions, including banks and insurance companies. Its intelligent automation and data-driven insights help manage sales processes, improve productivity, and drive growth.

Why I picked Vymo: Vymo reduces manual data entry by automatically capturing sales activities and providing actionable insights to improve sales performance. The platform offers lead management, sales tracking, and performance analytics features. With Vymo's real-time data, you can effectively monitor and coach your sales team. Its mobile-first approach ensures your team can stay productive on the go.

Standout features & integrations:

Features include automated lead capture, intelligent sales assistance, and real-time performance analytics. Vymo helps you manage your sales pipeline efficiently and provides actionable insights to drive better outcomes. The mobile-first design ensures your team can access critical functionalities anytime, anywhere.

Integrations include Salesforce, Microsoft Dynamics, Zoho CRM, HubSpot, Oracle CRM, SAP CRM, Freshsales, Pipedrive, SugarCRM, and Zendesk.

Pros and cons

Pros:

- Automated lead capture

- Real-time data insights

- Mobile-first design

Cons:

- Limited customization

- Requires technical knowledge

Insightly is a cloud-based CRM platform designed primarily for small to medium-sized businesses. It helps teams manage customer relationships, track sales pipelines, and oversee project management tasks.

Why I picked Insightly: Insightly lets you manage your sales, projects, and customer data in one place. Customizable dashboards provide real-time insights into your business metrics. The platform includes tools for email marketing, task management, and workflow automation. Your team can also benefit from its mobile app, which ensures you stay connected on the go.

Standout features & integrations:

Features include customizable dashboards, email marketing tools, and task management capabilities. You can automate workflows to save time and reduce manual efforts. The mobile app keeps your team connected, no matter where they are.

Integrations include Google Workspace, Microsoft Office 365, QuickBooks, Slack, Mailchimp, Xero, Dropbox, Evernote, Box, and Zapier.

Pros and cons

Pros:

- Customizable dashboards

- Email marketing tools

- Mobile app availability

Cons:

- No financial-related features

- Requires time to learn

SalesmateCRM is customer relationship management software designed to assist businesses in managing their sales processes, customer relationships, and marketing activities. It primarily serves small—to medium-sized enterprises looking to enhance customer engagement and boost sales efficiency.

Why I picked SalesmateCRM: SalesmateCRM offers a highly customizable platform that fits various business processes, making it adaptable to your unique needs. It features an intuitive interface that helps your team quickly get up to speed. The software integrates marketing, sales, and customer support under one platform, providing a unified view of customer interactions. Additionally, it includes automation tools that streamline repetitive tasks, allowing your team to focus on building relationships and closing deals.

Standout features & integrations:

Features include sales automation, email tracking, and contact management, which help you stay on top of your tasks and improve client communication. You can also use built-in calling to make and log calls directly within the CRM, making it easier to track interactions. The pipeline management feature lets you visualize your sales process, helping your team prioritize and manage deals effectively.

Integrations include Google Drive, Salesforce, Zendesk, Asana, Basecamp, Box, Dropbox, Tableau, Trello, Typeform, WordPress, and YouTube.

Pros and cons

Pros:

- Built-in calling feature

- Unified platform

- Scalable for SMBs

Cons:

- Limited financial features

- Requires time to customize

Pipeliner CRM is a customer relationship management software designed for sales teams and managers to handle sales processes efficiently. It aids in account management, pipeline management, and sales forecasting.

Why I picked Pipeliner CRM: I liked this tool for its pipeline visualization feature, which helps you see where your deals are and manage your sales process effectively. It offers advanced reporting tools that provide insights into your sales performance. Pipeliner CRM also includes tools for account management, enabling you to handle multiple accounts and related information efficiently. Your team can benefit from its duplicate checker feature, ensuring clean and accurate data in your CRM.

Standout features & integrations:

Features include pipeline visualization, advanced reporting, and account management tools. These features enable your team to manage sales processes effectively, gain insights into sales performance, and handle multiple accounts efficiently.

Integrations include Google Suite, Microsoft Suite, Mailchimp, Zapier, QuickBooks, HubSpot, Slack, LinkedIn, Twitter, and Dropbox.

Pros and cons

Pros:

- Pipeline visualization

- Advanced reporting

- Account management tools

Cons:

- Complex setup

- Limited customization

Other Banking CRM Software

Here are some additional banking CRM solutions options that didn’t make it onto my shortlist but are still worth checking out.

- SugarCRM

For customizable solutions

- Zoho CRM

For multichannel communication

- Microsoft Dynamics 365

For enterprise resource planning

- HubSpot CRM

For marketing automation

- monday CRM

For custom automation

- Oracle NetSuite CRM

For financial management integration

- Pipedrive

For visual sales pipeline

- Salesforce Financial Services Cloud

For financial service providers

- BankPoint

For bank portfolio management

- Copper CRM

For Google Workspace integration

Banking CRM Software Selection Criteria

I considered everyday buyer needs and pain points when selecting the best banking CRM software to include in this list. I also used the following framework to keep my evaluation structured and fair.

Core Functionality (25% of total weighting score)

To be considered for inclusion in this list, each solution had to fulfill these common use cases:

- Manage customer data

- Schedule appointments

- Send personalized communications

- Track customer interactions

- Generate reports

Additional Standout Features (25% of total weighting score)

To help further narrow down the competition, I also looked for unique features, such as:

- AI and machine learning capabilities

- Integrated omnichannel communications

- Advanced workflow automation

- Detailed financial and investment tracking

- Customizable loyalty programs

Usability (10% of total weighting score)

To get a sense of the usability of each system, I considered the following:

- Intuitive user interface

- Ease of customization

- Efficiency in navigation and task completion

- Availability of mobile access

- Quality of visual design

Onboarding (10% of total weighting score)

To evaluate the onboarding experience for each platform, I considered the following:

- Availability of interactive product tours

- Access to training videos and webinars

- Presence of onboarding templates

- Support from chatbots or dedicated onboarding teams

- Ease of data migration from previous systems

Customer Support (10% of total weighting score)

To assess each software provider’s customer support services, I considered the following:

- Availability of 24/7 support

- Multiple support channels (chat, email, phone)

- Quality and speed of response

- Availability of a comprehensive knowledge base

- Personalized support options

Value For Money (10% of total weighting score)

To evaluate the value for money of each platform, I considered the following:

- Competitive pricing compared to features offered

- Flexible pricing plans

- Transparent pricing without hidden fees

- Availability of free trials or demos

- Discounts for long-term commitments

Customer Reviews (10% of total weighting score)

To get a sense of overall customer satisfaction, I considered the following when reading customer reviews:

- Overall satisfaction ratings

- Commonly mentioned benefits and drawbacks

- Customer feedback on support quality

- Reviews on ease of use and implementation

- User testimonials and case studies

Trends In Banking CRM Software

In my research, I sourced countless product updates, press releases, and release logs from different banking CRM software vendors. Here are some of the emerging trends I’m keeping an eye on.

- Advanced AI and Machine Learning Integration: AI and ML are essential in banking CRM systems to enhance customer insights and automate routine tasks.

- Enhanced Customer Insights and Personalization: Banks use CRM tools to gather and analyze data for deeper customer insights. This helps them personalize services and products based on customer behavior and preferences.

- Omnichannel Customer Engagement: Integrating various customer touchpoints into a unified CRM system is gaining traction. This ensures a consistent experience across mobile, online, and in-branch services..

- Regulatory Compliance and Data Security: With increasing regulatory requirements, CRM software is now focusing on features that ensure compliance and data protection.

- Integration of Advanced Analytics and BI Tools: Banks leverage CRM systems with built-in business intelligence tools for better decision-making. These tools help visualize data trends and make informed business decisions.

What Is Banking CRM Software?

Banking CRM software is a specialized tool financial institutions use to manage customer relationships, track interactions, and analyze data. Bankers, financial advisors, and customer service representatives use these tools to enhance customer satisfaction and drive business growth. By providing a centralized platform for customer data, these tools help users deliver personalized services and improve operational efficiency.

Features like customer segmentation, automated communications, and data analytics support better decision-making and customer interactions. These tools improve customer management and business performance in the banking sector.

Features Of Banking CRM Software

When selecting the best CRM software, keep an eye out for the following key features:

- Centralized data management: A central repository for customer data, including lead and opportunity management capabilities, helps improve data accessibility and organization.

- Marketing efforts and sales automation: Tools for automating email marketing campaigns, lead scoring, and 360-degree view sales forecasting to enhance efficiency and accuracy.

- Customer service management: Features like ticket management and automated responses to enhance customer support and satisfaction.

- Analytics and reporting: Customizable dashboards and reports to track performance metrics and customer interactions, aiding in data-driven decision-making.

- Integration capabilities: Seamless integration with other platforms like core banking systems, email servers, and marketing tools to streamline operations.

- Security and compliance: solid data protection measures and compliance with financial regulations to ensure customer data security and trust.

- Mobile access: Mobile cross-selling CRM capabilities allow banking professionals to access customer information and perform tasks on the go.

- Customer segmentation: Advanced segmentation tools to categorize customers based on various criteria, aiding in personalized marketing and service.

- Workflow automation: Automated workflows to streamline internal processes, reduce manual tasks, and improve operational efficiency.

- Customer insights: Tools for gathering and analyzing customer profile messaging preferences and behaviors to tailor services and improve customer relationships.

Benefits Of Banking CRM Software

Implementing banking CRM software provides several benefits for your team and your business. Here are a few you can look forward to.

- Improved customer insights: Banking CRM software captures and stores detailed customer data, helping your team understand customer needs and preferences.

- Enhanced communication: With centralized data, your team can facilitate more effective and personalized client communication.

- Increased customer retention: Banks can offer tailored financial solutions and build stronger customer relationships by leveraging customer data.

- Operational efficiency: Automating routine tasks like data entry and transaction management reduces manual workload and operational costs.

- Sales growth: CRM tools help track sales pipelines and manage client outreach, supporting your team in closing more deals.

- Regulatory compliance: By maintaining accurate and up-to-date customer records, CRM software aids in meeting regulatory requirements.

- Employee productivity: Access to organized and comprehensive customer information allows employees to work more efficiently and effectively.

Costs & Pricing Of Banking CRM Software

Selecting banking CRM software requires understanding the various pricing models and plans available. Costs vary based on features, team size, add-ons, and more. The table below summarizes standard plans, average prices, and typical features of banking CRM software solutions.

Plan Comparison Table for Banking CRM Software

| Plan Type | Average Price | Common Features |

| Free Plan | $0/user/ month | Basic contact management, limited storage, email integration, and basic reporting. |

| Personal Plan | $10-$20/ user/month | Advanced contact management, custom dashboards, email tracking, and basic automation. |

| Business Plan | $30-$60/ user/month | Workflow automation, advanced analytics, third-party integrations, and enhanced customer support. |

| Enterprise Plan | $100-$300/ user/month | Customizable solutions, dedicated account manager, advanced security features, and comprehensive analytics. |

Banking CRM Software FAQs

Here are some answers to common questions about banking CRM software:

What banking CRM software does the US Bank use?

The US Bank uses Salesforce to manage all customer data in one unified system. Integrating all branches and customer touchpoints helps them deliver a consistent customer experience. Your team will benefit from having a holistic view of customer interactions and data.

What CRM system does Bank of America use?

Bank of America uses Mosaic CRM to manage its customer relationships. This system helps them track client interactions and streamline communications. If you’re looking for a reliable CRM, Mosaic CRM is an option worth considering based on its use by a central banking institution.

How do banks benefit from using CRM software?

Banks benefit from CRM software by improving customer satisfaction and retention. The software helps your team track interactions, automate routine tasks, and analyze customer data to offer personalized services. This leads to better customer experiences and potentially higher revenue.

What should you look for in a banking CRM?

When choosing a banking CRM, look for features like customer data integration, automation capabilities, and solid analytics. Ensure the CRM can handle compliance requirements specific to banking. Your team should also find the software intuitive to use, which can help with faster onboarding and adoption.

Can a banking CRM integrate with other banking systems?

Yes, most banking CRMs can integrate with other banking systems, such as core banking platforms, loan origination systems, and payment gateways. Integrations help your team work more efficiently by providing a unified view of customer information. Before deciding, check the CRM’s compatibility with your existing systems.

How secure is banking CRM software?

Banking CRM software typically includes multiple layers of security, such as data encryption and user authentication. Ensuring the CRM complies with financial regulations like GDPR and PCI-DSS is crucial. Your team should also regularly update the software to protect against new security threats.

What’s Next?

Want to take your RevOps game to the next level?

Subscribe to The RevOps Team newsletter for expert advice, software reviews, and other resources to help you deliver predictable growth at scale.