There’s an old saying that you have to spend money to make money, so many companies spend 20% or more of their revenue on marketing to increase sales. Understanding the difference between the two—revenue vs sales—is vital if you want to truly understand your company’s financials and plan the appropriate budgets for your departments. Here, we’re going to break down those two figures and explain some of the key differences between them that many people overlook.

Revenue vs Sales: What’s the Difference?

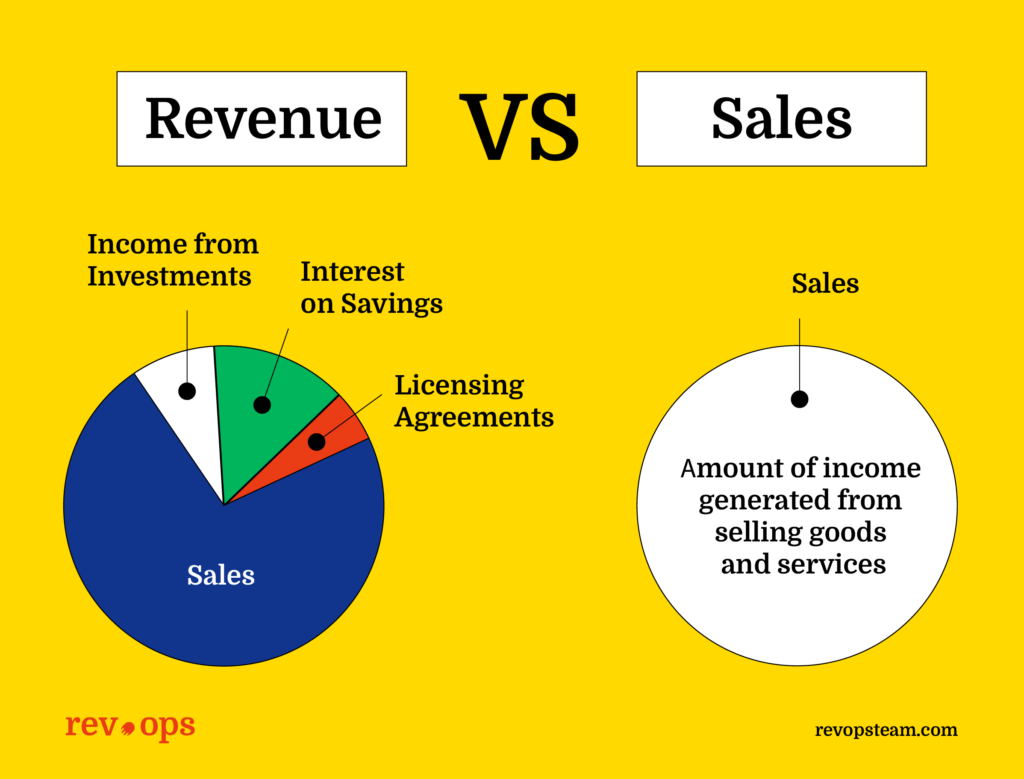

Revenue is the total amount of income generated by a company, and that can come from any source. In contrast, sales are the amount of income generated from selling goods and services. If you have a relatively young company and you haven’t yet launched your product, you might look to generate revenue from other sources. For example, renting out some of your office space to give yourself breathing room while you prepare to bring your products to market.

Notably, it is possible for revenue to be lower than sales. This is because sales typically refers to the gross income from sales, rather than the income generated after things like sales returns or discounts are taken into account.

If a company incurs costs due to replacements, discounts and deductions and those costs outweigh any income generated from non-sales sources, a company’s revenue could be lower than its sales. That said, it is more common for sales to be lower than revenue because revenue includes all of a company’s income sources.

Understanding Gross Sales and Net Sales

Revenue might be the most important figure when it comes to the immediate health of a business, but sales is the one that gets all the attention when it comes to shareholder meetings and press reports.

Sales refers to the income generated from selling goods and services to customers. This often appears on an income statement as “gross sales."

Gross sales is all the income generated from the sale of goods or services, and it ignores any discounts, refunds or other things that might reduce that income. For example, if a company sells software and generates $50,000 worth of sales as tracked in their chosen reporting software but gives out discounts totaling $1,500 and refunds some people for a total of $500 worth of purchases, its net sales would be $48,000.

Put simply, sales are a subset of revenue, while revenue takes into account other sources of income.

Sales are a useful metric, but they aren’t the only or even most important thing that a company should consider. Cash flow, for example, is a crucial thing to take into account. Even if the amount of money generated by sales over the course of a year is higher than the company’s outflows, the company could still find itself insolvent if that income did not line up with any bills it had to pay.

For this reason, a cash flow forecast would look at the top line and the gross profit over the course of the year as well as the cost of goods sold in a given period of time. Many cash flow forecasts look at income and outflows on a month-to-month basis to get a clearer idea of how sustainable a business might be.

Gross sales and net sales are things you might want to take into account when assessing the performance of your business. If you see your sales are plateauing or even slowing down, it might be time for you to look at expanding your target market or researching new products to appeal to your current customer base.

Understanding Revenue

Revenue covers all kinds of income. For some companies, the sales and revenue figures may be the same–but this isn’t always the case. Many businesses have multiple income streams. In addition to the income they generate from sales, they may receive income from other sources such as licensing agreements, interest on savings, or income from investments.

Let’s consider the example of a small taxi company that operates a fleet of cars. In the last year, this company generated income providing transportation services but also got some interest on its cash reserves and received some income for selling old fleet vehicles. Its income statement may show the following:

- Income from taxi services: $100,000

- Interest on savings: $1,500

- Used car sales: $15,000

Sale of assets doesn’t count as sales income because the company isn’t in the business of buying and selling cars.

The taxi company’s total revenue was $116,500, of which $100,000 is revenue from sales. This is the gross revenue.

Net Revenue

Net revenue is calculated by taking the gross revenue figure and subtracting expenses from it. These expenses could include the cost of goods sold, venue overheads such as rent and utilities, and staffing costs.

There are several types of revenue streams to consider, including:

- Income from investment

- Charges and interest (for example fees for late payment by customers)

- Royalties and licensing fees

- Income from the sale of assets

- Other fees, such as charges for copies made, travel time or mileage reimbursements

The above list is not exhaustive. Essentially, any income that is not from sales would be considered revenue and would appear on that section of the balance sheet.

Non-Operational Revenue

Another useful measure of revenue is “non-operational revenue." This takes into account income from royalties, donations, liquidated assets and investments, as well as one-off gains such as payments from court cases. Non-operational revenue is usually a very small portion of a company’s overall income.

What You Need to Know About Revenue and Sales

These rules of thumb might help you remember the differences between revenue and sales, so you know what you’re looking for when you’re reading a company’s financial statements:

- Revenue and sales have distinct meanings in the accounting world and should be easy to differentiate on a balance sheet.

- Revenue can come from non-sales sources. However, sales are a form of revenue. It is possible for a company to have revenue without making any sales.

- There are exceptions to the above. For example, government agencies may sell goods or services but typically report their income as being revenue, no matter the source.

- Sales can be used to get an idea of how well a company is doing in terms of its core business. Revenue gives an indication of how flexible a company is and how good it is at generating money through additional sources.

More Articles

- The 17 Best Account Management Books to Master Client Journeys

- What is Sales Forecasting? Your Key to Informed Decisions

- What is CPQ: A Guide to ‘Configure, Price, Quote’ for RevOps Teams

- 4 Benefits of Conversation Intelligence Software: How Can It Enhance Your Operations?

- 18 Business Intelligence Books You Can’t Miss

Both Metrics Are Valuable for Business Owners

By comparing revenue and sales, a business can better understand the difference between the income it gets from its core business operations and any non-operating income. You can use revenue calculations to understand the current health of your company, but try not to fixate on that bottom line. Always keep in mind that it’s possible for a company to be in net profit while having low or poor sales, especially if your business has multiple revenue streams.

For this reason, it’s a good idea to take into account gross and net profits, as well as profit margins, when considering the overall health of your business. A small business that relies on a handful of sales each quarter, perhaps dealing in luxury goods, needs a relatively high gross profit margin. In contrast, a supermarket that has reasonably predictable and very high sales volumes can survive with much thinner margins and still post high sales and revenue figures. You know the niche you operate in better than anyone else. Use that knowledge to work out what sort of profit margin you need to keep your business sustainable.

Track Revenue and Sales for Deeper Insights

As we’ve shown, revenue and sales are related, but distinct, metrics. Sales figures look at one specific area of income, while revenue covers all of your business’ income sources.

If you’re interested in sales forecasting or want to learn more about sales intelligence and revenue intelligence platforms, sign up for our newsletter to get access to our industry-leading revenue and sales tools and insights.